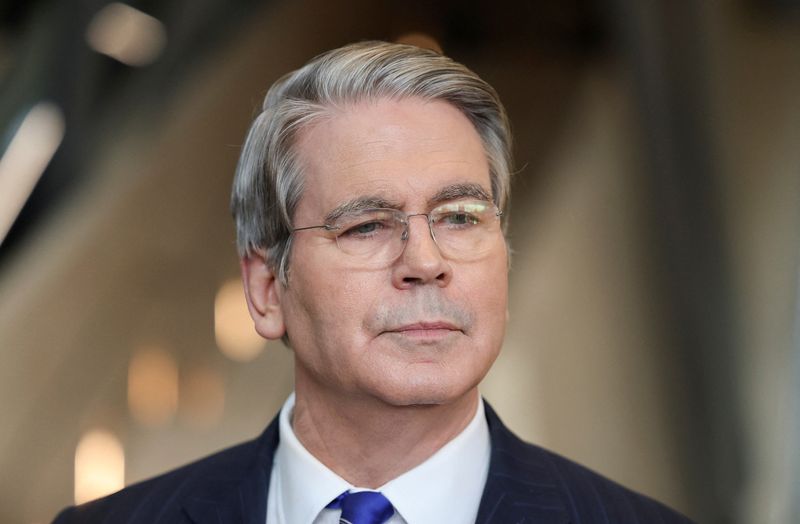

Royal Caribbean shares tumble as revenue misses estimates

NegativeFinancial Markets

Royal Caribbean's shares have taken a hit after the company's revenue fell short of analysts' expectations. This decline is significant as it reflects broader challenges in the cruise industry, which has been struggling to recover post-pandemic. Investors are concerned about the company's ability to rebound, making this news particularly relevant for those tracking the stock market and the travel sector.

— Curated by the World Pulse Now AI Editorial System