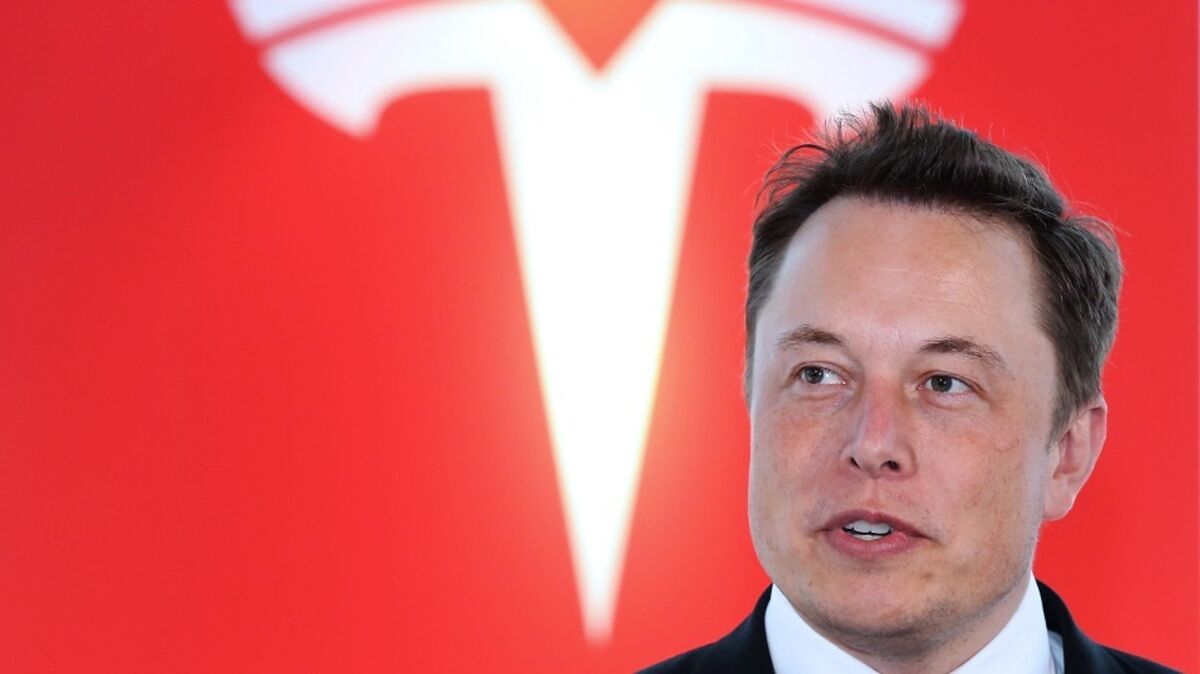

Elon Musk’s ‘Grokipedia’ cites Wikipedia as a source, even though it’s the exact thing he’s trying to replace because he thinks it’s ‘woke’

NeutralFinancial Markets

Elon Musk's new project, Grokipedia, aims to challenge traditional sources of information like Wikipedia, which he has criticized as 'woke.' Despite this, Grokipedia still cites Wikipedia as a source, raising questions about its effectiveness in providing unbiased information. This development is significant as it highlights the ongoing debate over the reliability of information in the digital age and Musk's vision for a new kind of knowledge platform.

— Curated by the World Pulse Now AI Editorial System