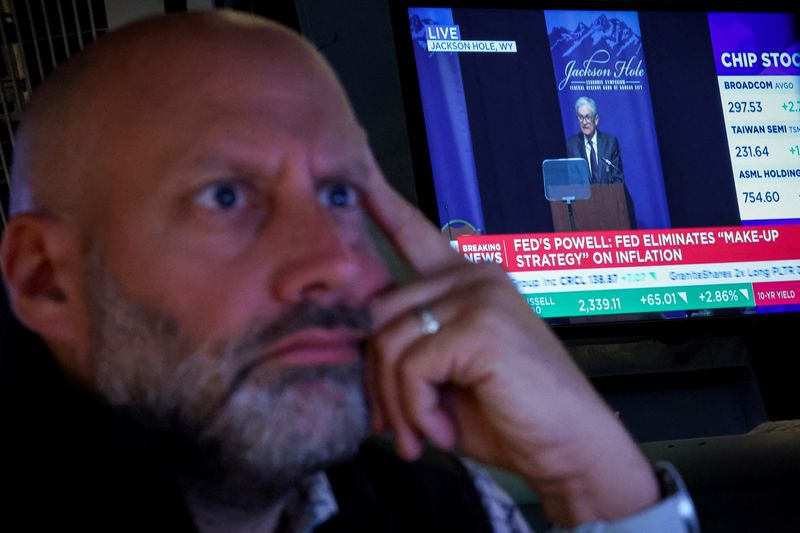

Investors look to jobs data to support rate-cut path, pricey stock market

NeutralFinancial Markets

Investors are closely monitoring upcoming jobs data as they seek indicators that could support a potential path for interest rate cuts. With the stock market currently priced at high levels, the jobs report could provide crucial insights into the economy's health and influence future monetary policy decisions. This is significant as it may affect investment strategies and market stability.

— Curated by the World Pulse Now AI Editorial System