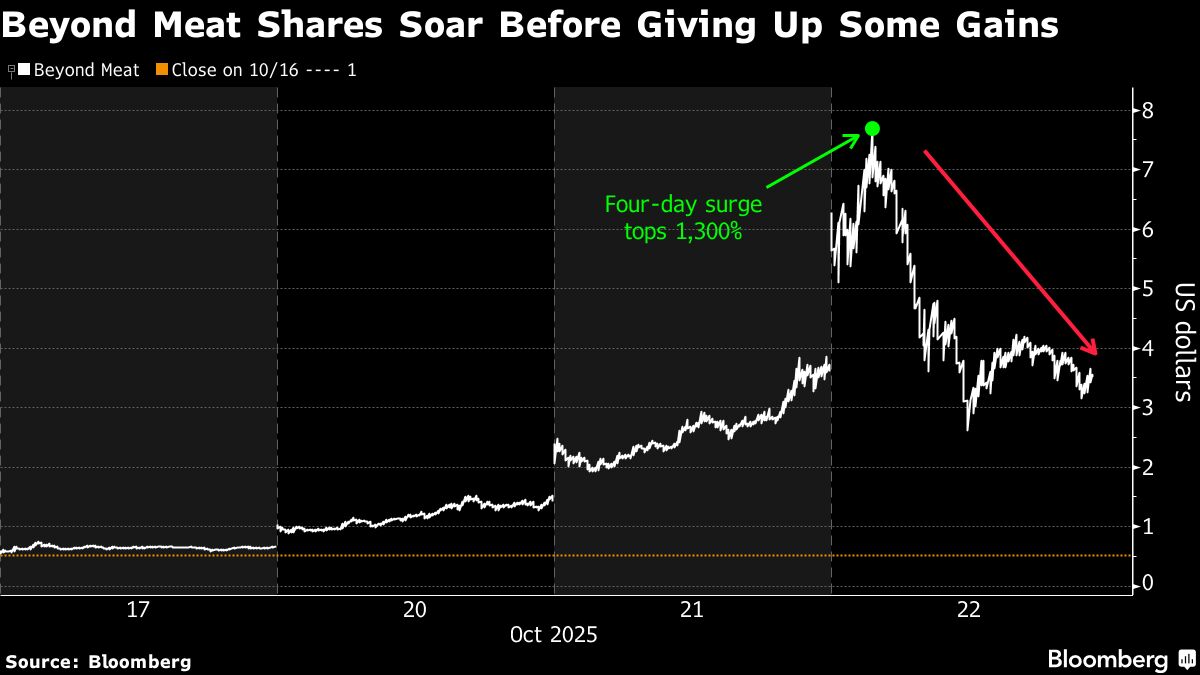

Why Beyond Meat shares surged over 1,000% in four days

PositiveFinancial Markets

Beyond Meat shares have seen an incredible surge of over 1,000% in just four days, driven by a wave of enthusiasm from retail traders. This dramatic rally highlights the growing interest in plant-based alternatives and suggests a potential turnaround for the company, which has faced challenges in the competitive food market. The surge not only reflects investor optimism but also underscores the increasing demand for sustainable food options.

— Curated by the World Pulse Now AI Editorial System