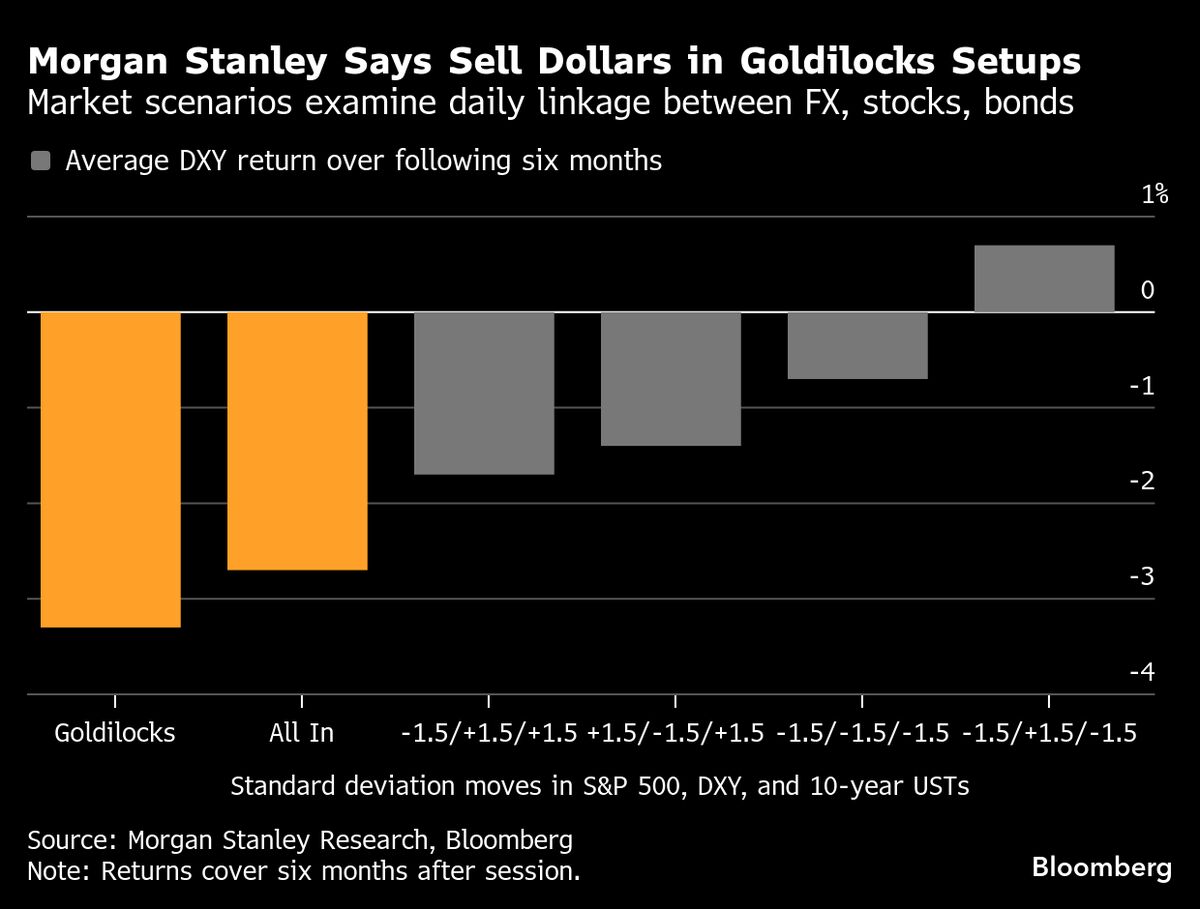

Morgan Stanley Says Sell Dollars in ‘Goldilocks’ Scenarios

PositiveFinancial Markets

Morgan Stanley has released a study suggesting that in a 'Goldilocks' scenario—where US stocks are on the rise while Treasury market losses remain limited—investors should consider shorting the dollar. This insight is significant as it provides a strategic approach for investors looking to navigate current market conditions effectively.

— Curated by the World Pulse Now AI Editorial System