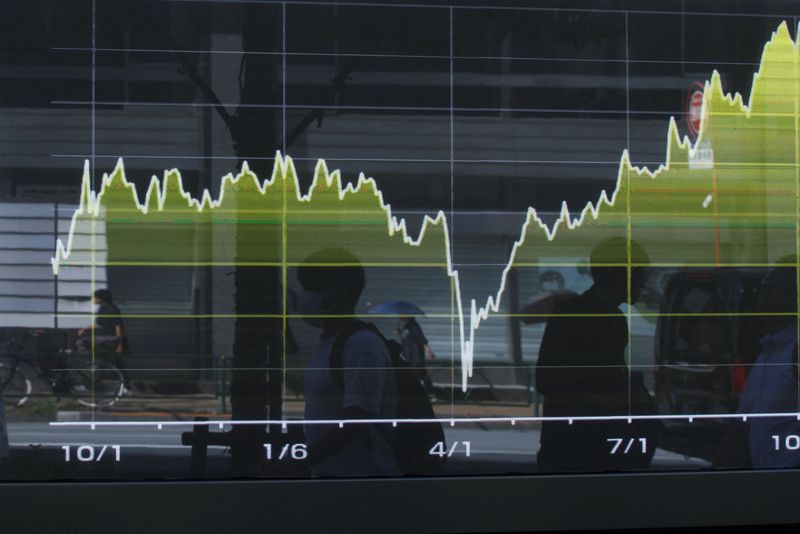

For 3 Years, the Bull Market Defied Inflation, Tariffs and Gravity

PositiveFinancial Markets

The bull market, which began during the Biden administration, has shown remarkable resilience over the past three years, even in the face of inflation and tariffs. Although it faced a potential downturn in April, the surge in artificial intelligence has provided a much-needed boost, allowing stocks to rally once again. This is significant as it highlights the market's ability to adapt and thrive despite economic challenges, offering hope for investors and the economy as a whole.

— Curated by the World Pulse Now AI Editorial System