Australia’s Coal State Faces Backlash for Hindering Transition

NegativeFinancial Markets

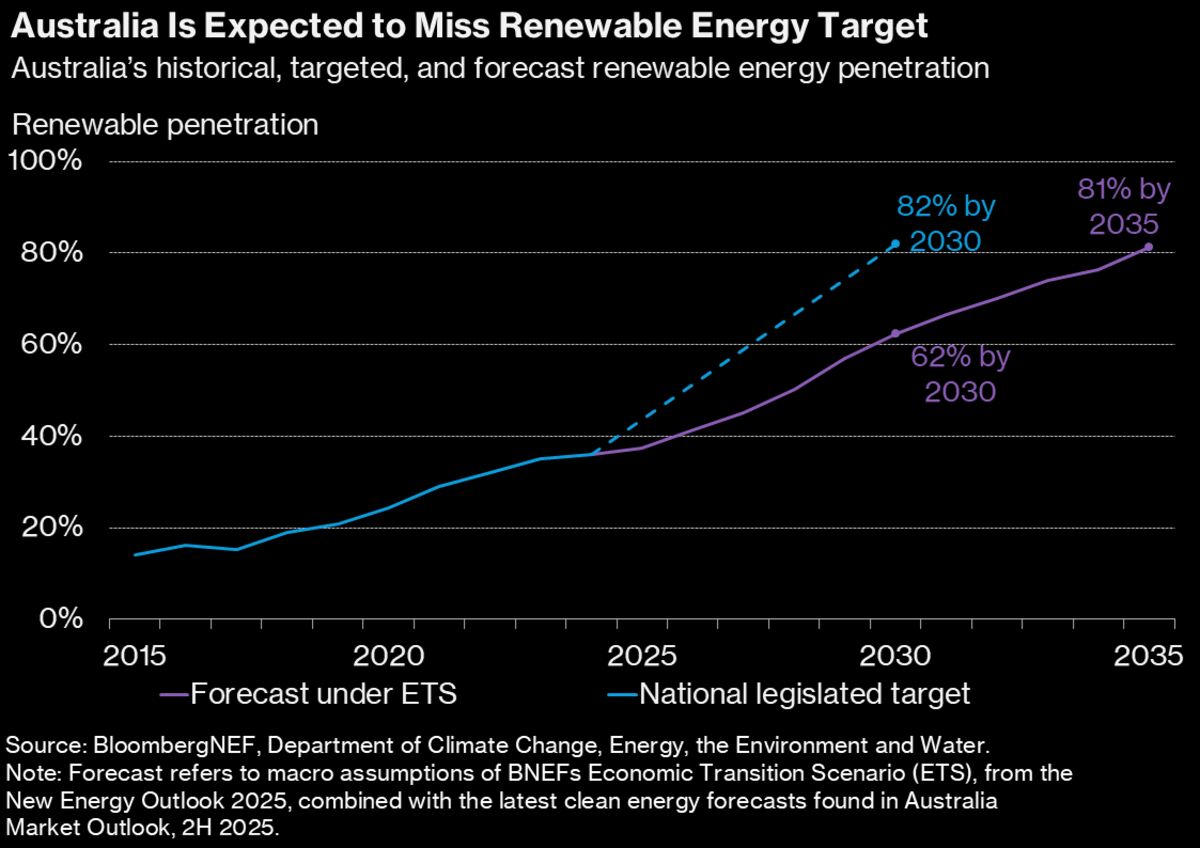

Queensland's recent decision to prolong the operation of its coal-fired power plants has sparked criticism from energy ministers across Australia. This move could deter investments in renewable energy projects, which are crucial for achieving the country's ambitious climate goals. As Australia grapples with the need for a sustainable energy transition, this backlash highlights the tension between traditional energy sources and the urgent push for cleaner alternatives.

— Curated by the World Pulse Now AI Editorial System