US Unveils Plan to Bolster Beef Output, Raises Argentine Quota

PositiveFinancial Markets

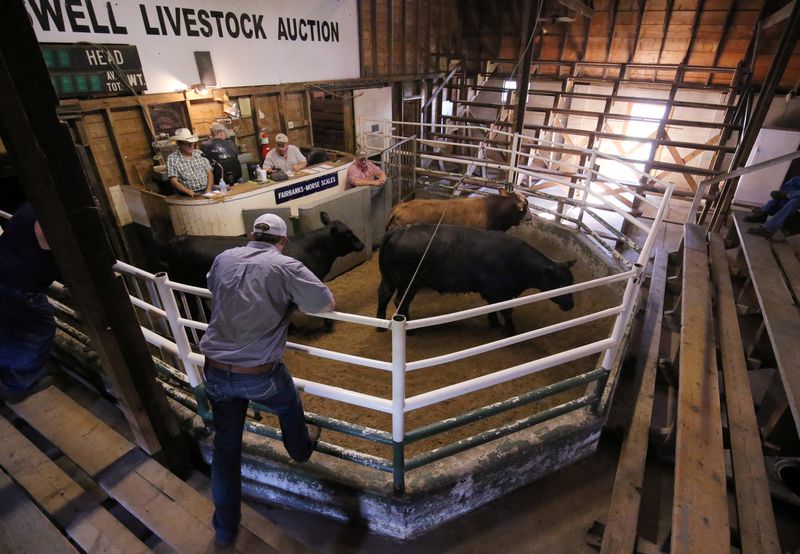

The Trump administration has announced a new plan aimed at increasing domestic beef production while also raising the quota for Argentine beef imports. This move is significant as it seeks to support American ranchers and enhance the beef supply in the U.S. market, potentially benefiting consumers with more options and competitive prices.

— Curated by the World Pulse Now AI Editorial System