Morgan Stanley acquires 5% stake in Alpha Group International

PositiveFinancial Markets

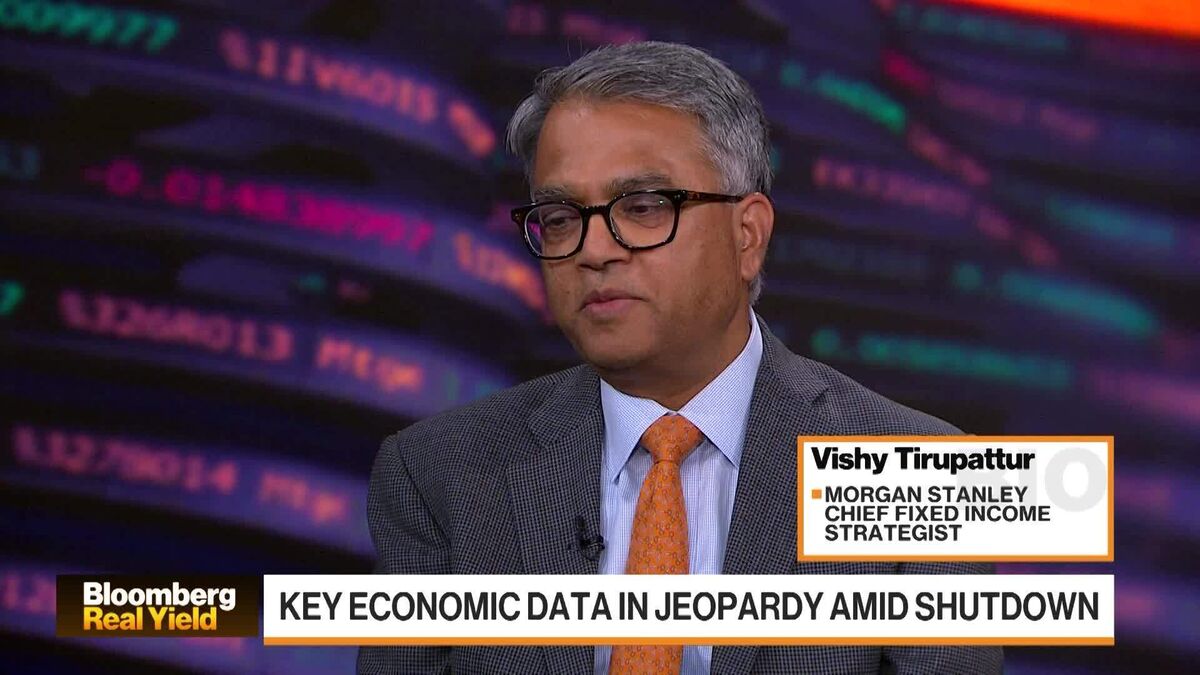

Morgan Stanley has made a strategic move by acquiring a 5% stake in Alpha Group International, signaling confidence in the company's potential for growth. This acquisition not only strengthens Morgan Stanley's investment portfolio but also highlights the increasing interest in Alpha Group's innovative solutions in the financial sector. Such partnerships are crucial as they can lead to enhanced collaboration and opportunities for both firms, ultimately benefiting their clients and stakeholders.

— Curated by the World Pulse Now AI Editorial System