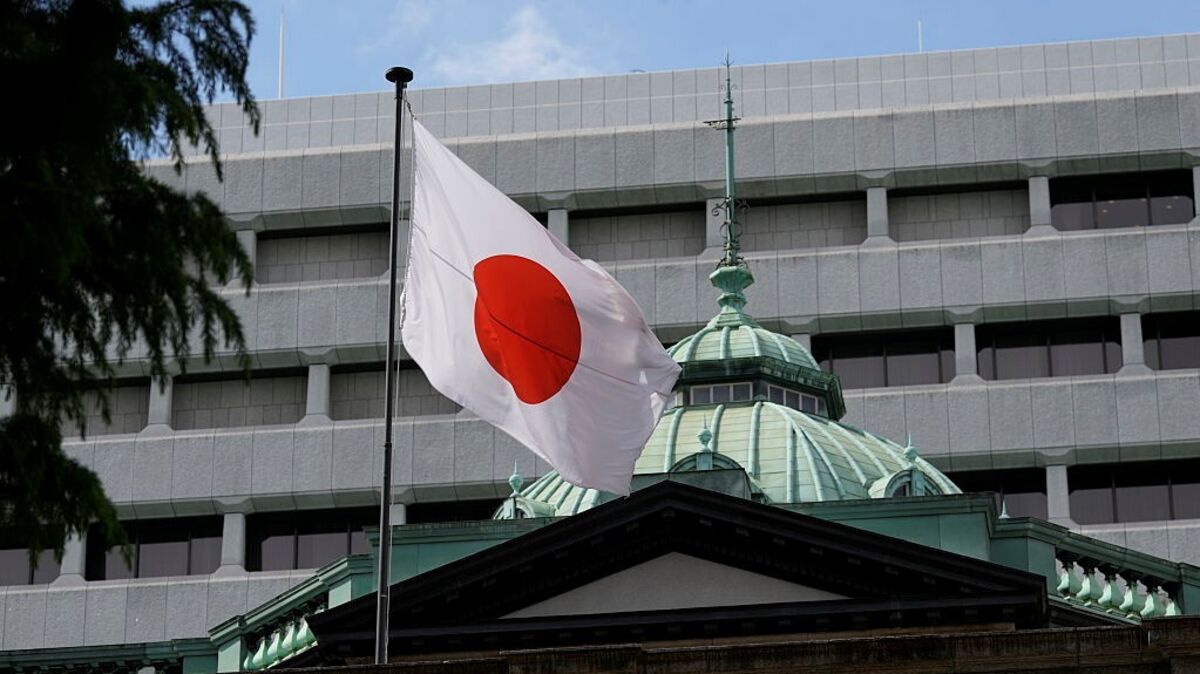

Japan’s ‘Widow-Maker’ Bond Trade Becomes World Beater

PositiveFinancial Markets

Japan's 'widow-maker' bond trade, which involves borrowing and selling Japanese government bonds in anticipation of falling prices, has emerged as a highly profitable strategy in the global bond market. Naomi Fink, chief global strategist at Amova Asset Management, highlighted this trend during her appearance on Bloomberg Television, emphasizing that it's rational to expect Japanese yields to rise. This development is significant as it reflects changing dynamics in Japan's economy and could influence global investment strategies.

— Curated by the World Pulse Now AI Editorial System