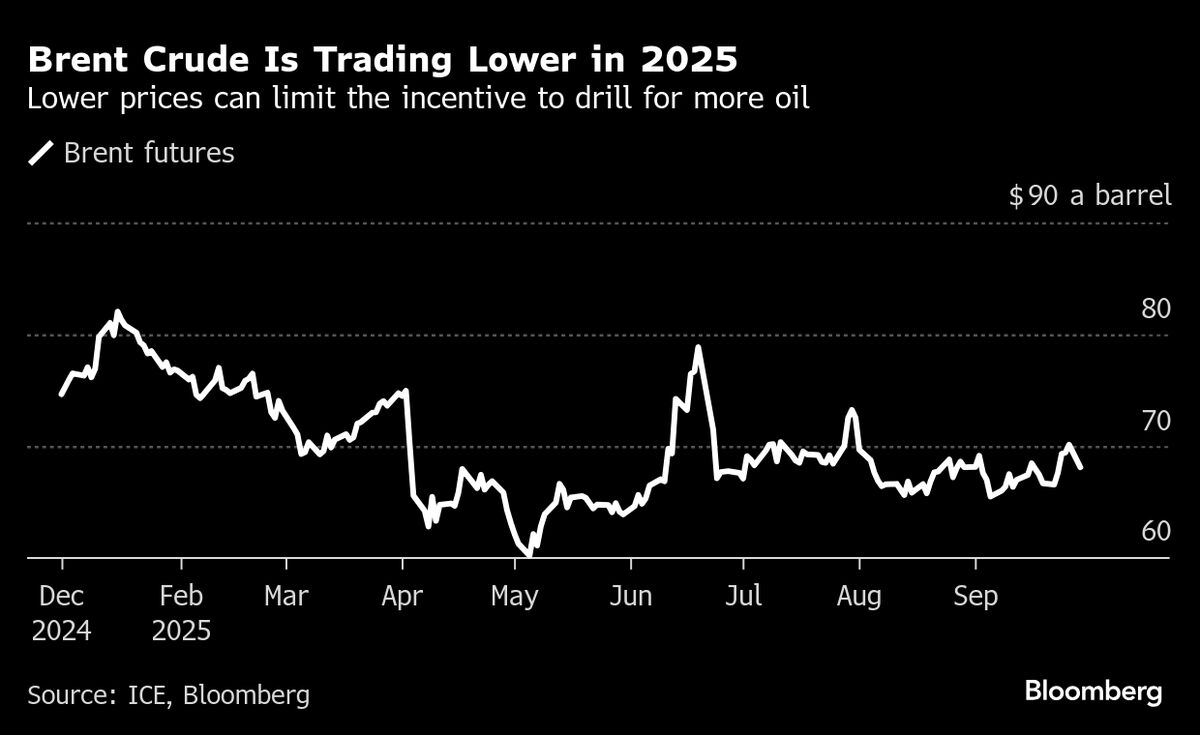

Oil dips as OPEC+ plan stokes supply-surplus concerns

NegativeFinancial Markets

Oil prices have dipped recently as concerns about a potential supply surplus grow, following OPEC+'s latest plans. This is significant because fluctuations in oil prices can impact global economies, affecting everything from fuel costs to inflation rates. Investors are closely monitoring these developments, as they could signal shifts in the energy market that may influence economic stability.

— Curated by the World Pulse Now AI Editorial System