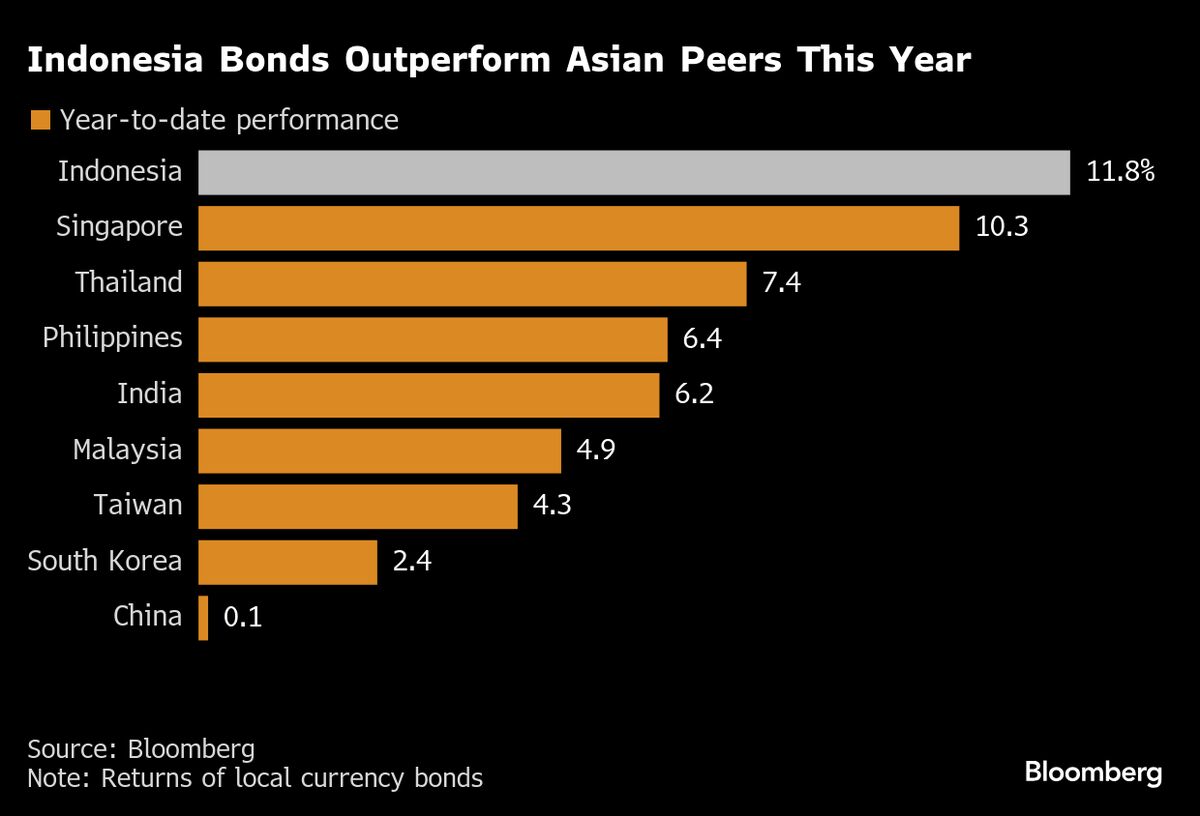

Indonesian Bonds Are Top Pick for Schroders on Purbaya, BI Bets

PositiveFinancial Markets

Schroder Investment Management has identified Indonesian bonds and the rupiah as its top investment choices in Asia. This positive outlook is based on the belief that the Indonesian government's initiatives to stimulate growth, along with anticipated interest-rate cuts, will attract foreign investments. This is significant as it highlights the potential for economic recovery and growth in Indonesia, making it an appealing destination for investors.

— Curated by the World Pulse Now AI Editorial System