The Snobs’ Attack On Gold Is Failing, Thanks To Bitcoin

PositiveFinancial Markets

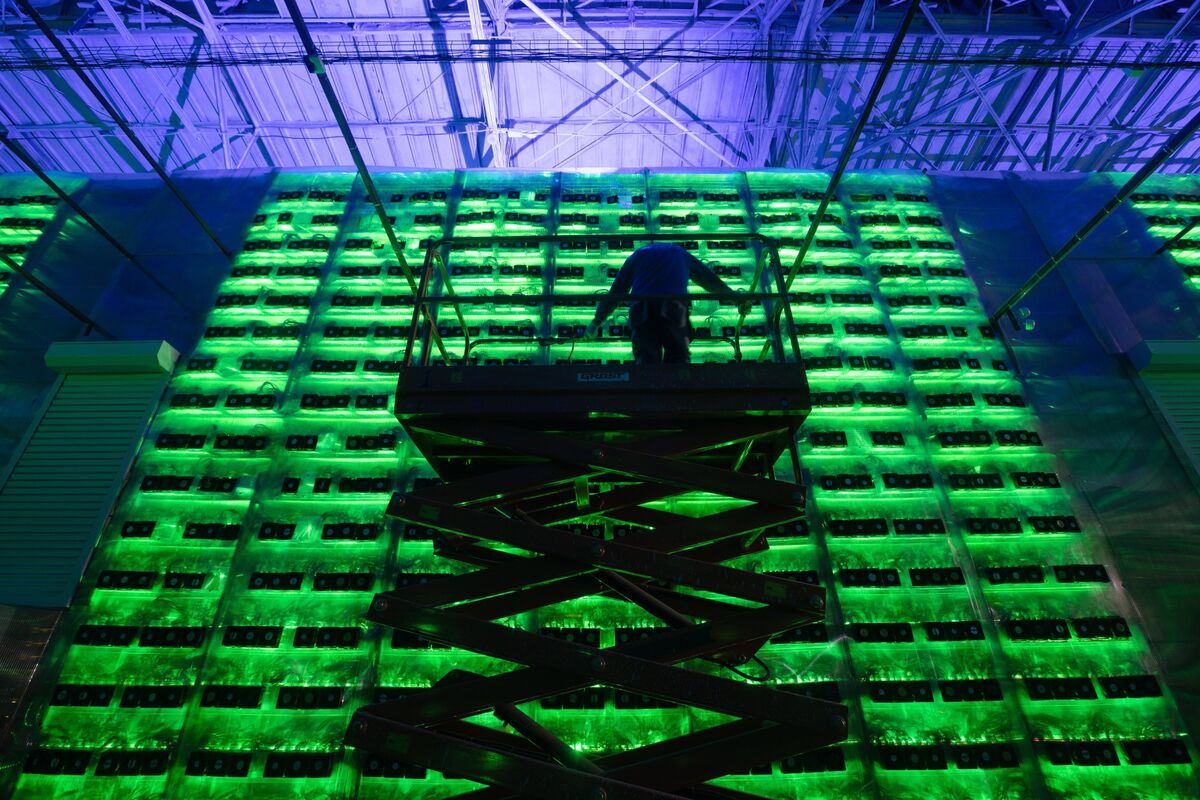

The recent criticism of gold by advocates of fiat money is losing its impact, largely due to the rise of Bitcoin. This shift highlights how traditional views on currency are being challenged by technological advancements. As Bitcoin gains traction, it represents a significant change in how we perceive value and wealth, making the conversation around gold increasingly irrelevant.

— Curated by the World Pulse Now AI Editorial System