Gold Boom Swells Indian Household Stock to Almost $3.8 Trillion

PositiveFinancial Markets

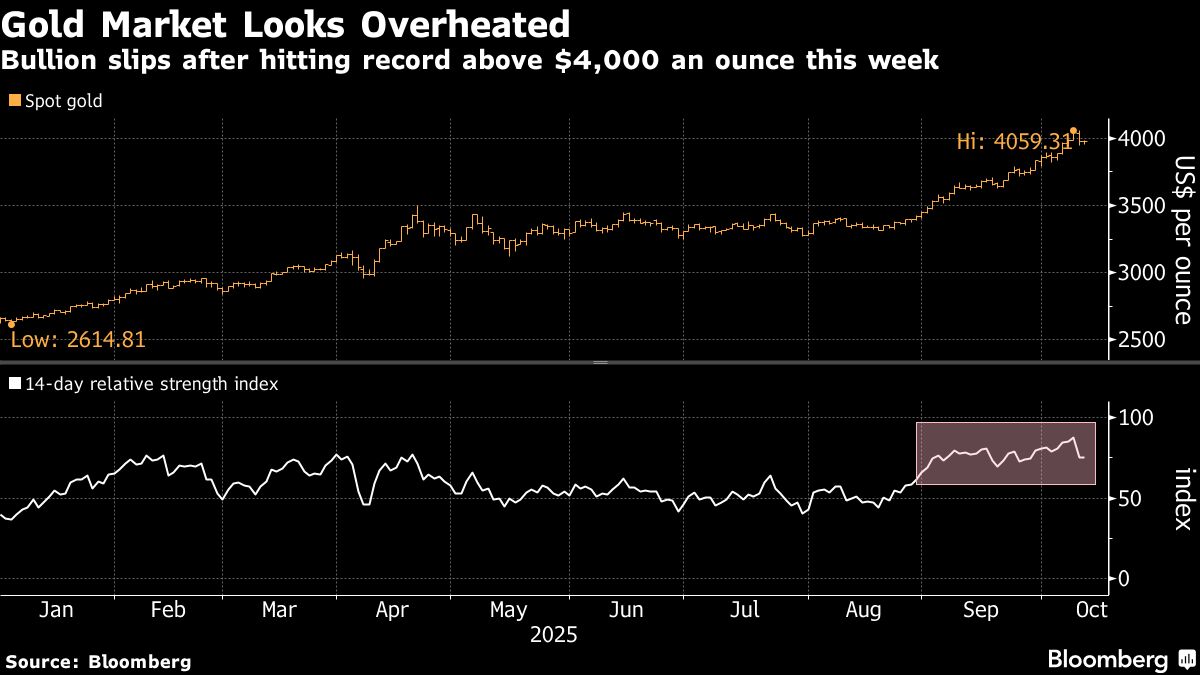

Indian households are experiencing a significant increase in wealth, with their gold holdings now valued at nearly $3.8 trillion. This surge follows a record rally in gold prices, highlighting the importance of gold as a stable asset in uncertain economic times. As these households benefit from rising gold values, it reflects broader economic trends and the potential for increased consumer spending.

— Curated by the World Pulse Now AI Editorial System