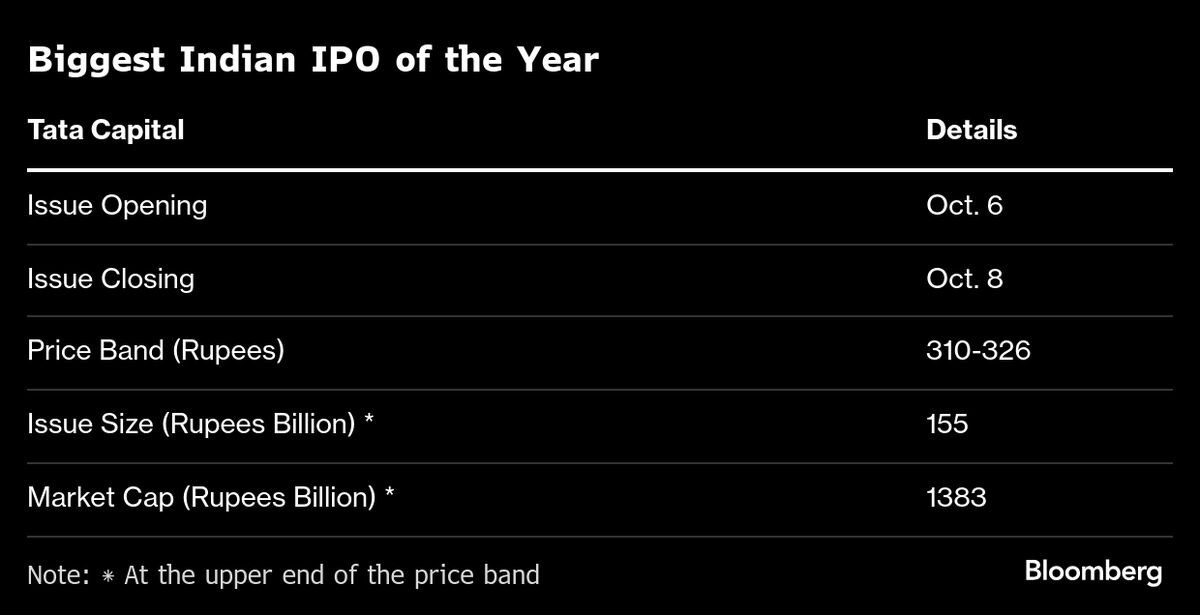

Tata Capital to Begin Taking Orders for $1.7 Billion IPO, India’s Largest This Year

PositiveFinancial Markets

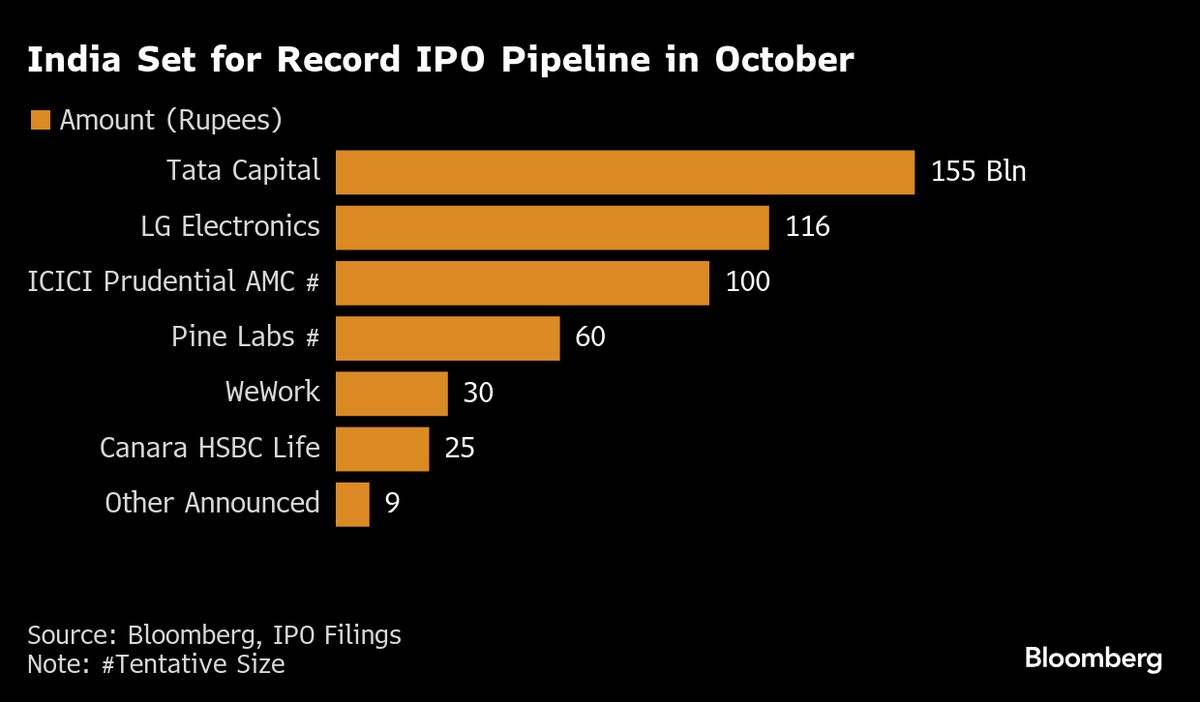

Tata Capital Ltd. is set to launch its initial public offering, aiming to raise up to $1.7 billion, marking it as India's largest IPO this year. This move is significant as it highlights the robust activity in India's IPO market, which is on track for a record month. Investors are keenly watching this development, as it could signal a strong recovery and growth potential in the Indian economy.

— Curated by the World Pulse Now AI Editorial System