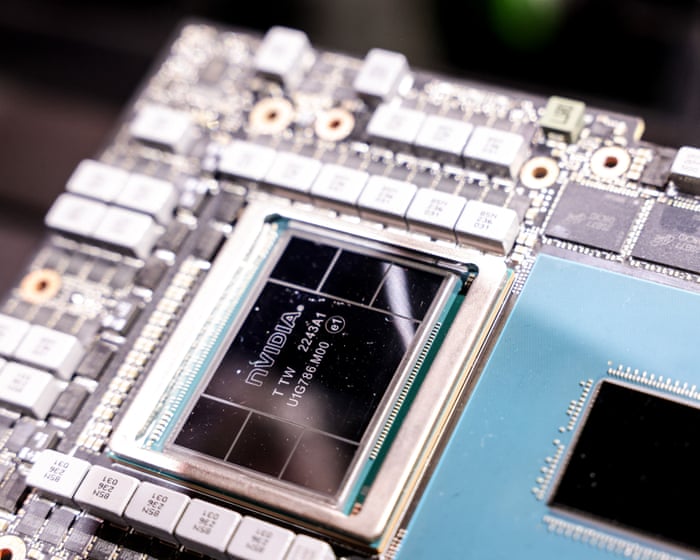

Nvidia becomes world’s first $5tn company amid stock market and AI boom

PositiveFinancial Markets

Nvidia has made history by becoming the world's first company to reach a $5 trillion valuation, just three months after surpassing the $4 trillion mark. This milestone highlights the booming artificial intelligence industry and the overall growth of the US stock market. Nvidia's impressive valuation now exceeds the GDP of major economies like India and Japan, showcasing its significant impact on the tech landscape and the economy at large.

— Curated by the World Pulse Now AI Editorial System