Traders Brace for Lower Treasury Yields as Hedging Costs Rise

NeutralFinancial Markets

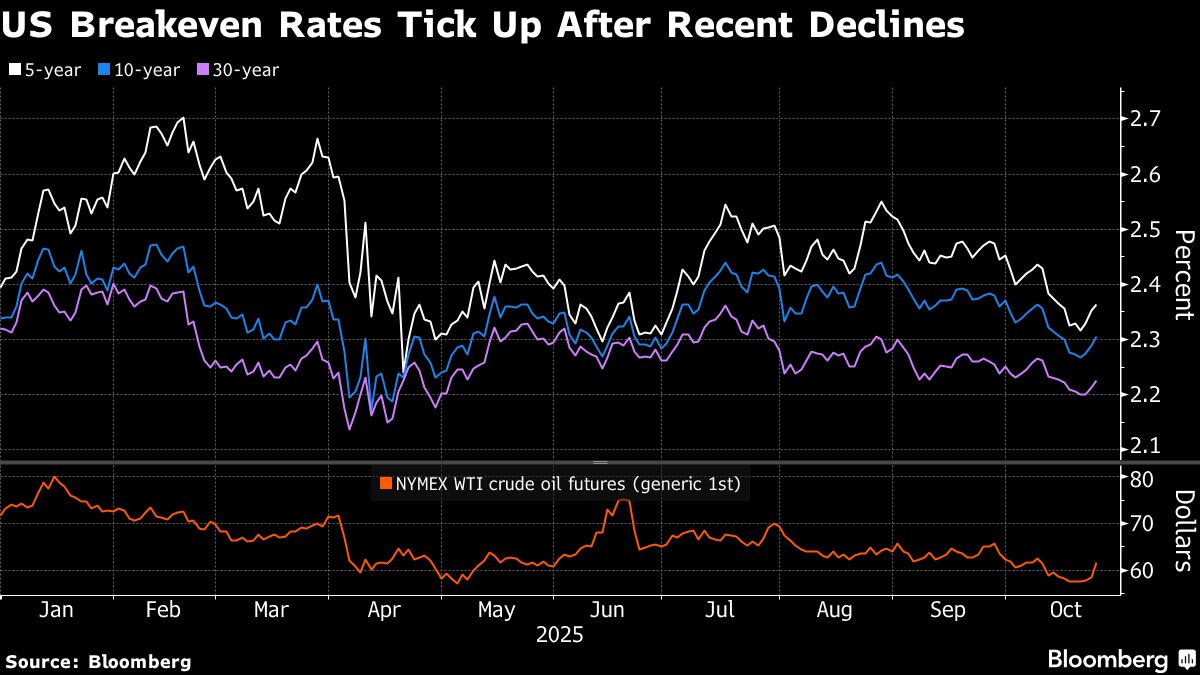

Bond traders are anticipating a further decline in Treasury yields, which recently hit a six-month low for the 30-year bond. This trend is significant as it reflects market adjustments and investor sentiment, particularly in response to rising hedging costs. Understanding these movements can help investors navigate the complexities of the bond market.

— Curated by the World Pulse Now AI Editorial System