How Long Can China Stocks Sustain Their Momentum?

NeutralFinancial Markets

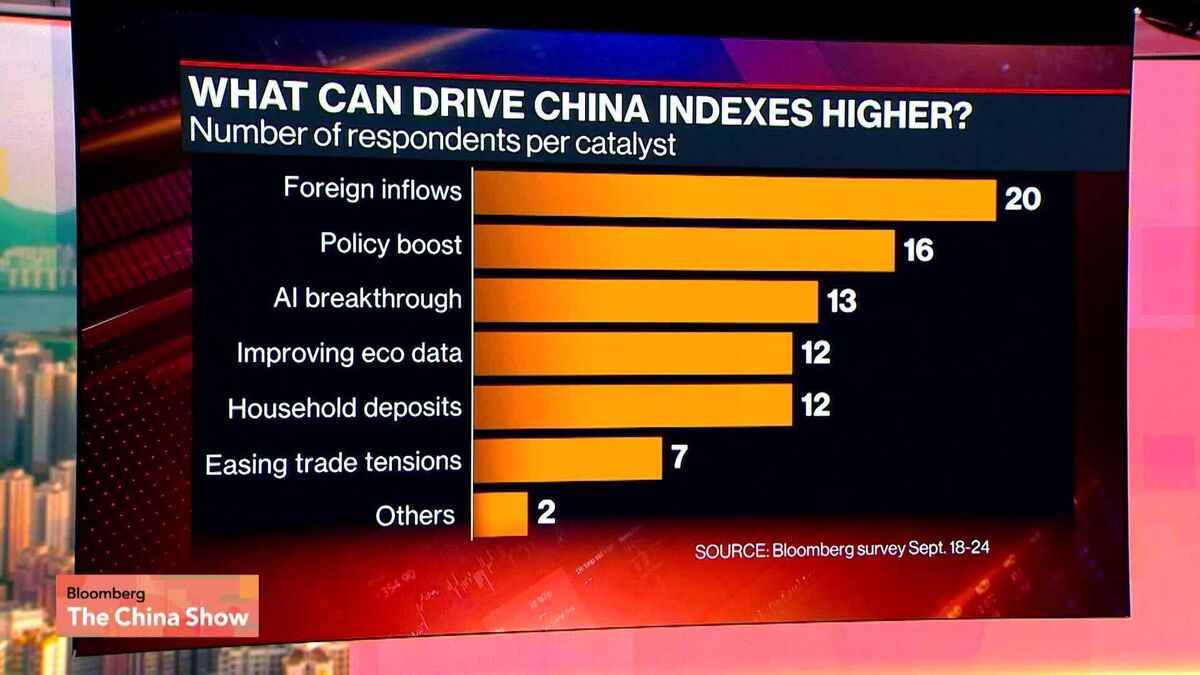

A recent Bloomberg survey indicates that analysts and money managers believe China's stock rally may start to lose momentum by the year's end, particularly in the AI sector, which is seen as crowded. Investors are keenly observing for potential catalysts in the final quarter, such as policy announcements and economic data, which could influence market trends. This insight is crucial as it helps investors navigate the shifting landscape of China's stock market.

— Curated by the World Pulse Now AI Editorial System