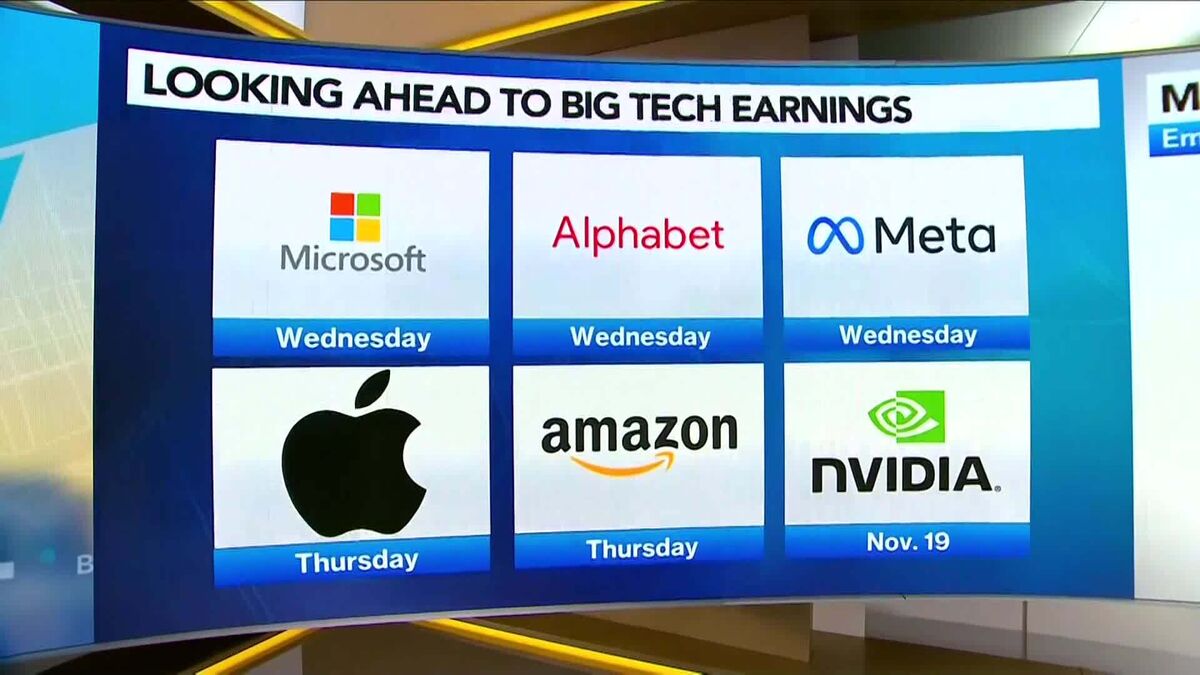

Microsoft Needs to Open Up More About Its OpenAI Dealings

NegativeFinancial Markets

Microsoft's lack of transparency regarding its dealings with OpenAI is raising concerns. As the tech giant continues to invest in AI, stakeholders are calling for clearer disclosures about its stake in OpenAI. This matters because transparency is crucial for building trust with investors and the public, especially in an era where AI's impact on society is under scrutiny.

— Curated by the World Pulse Now AI Editorial System