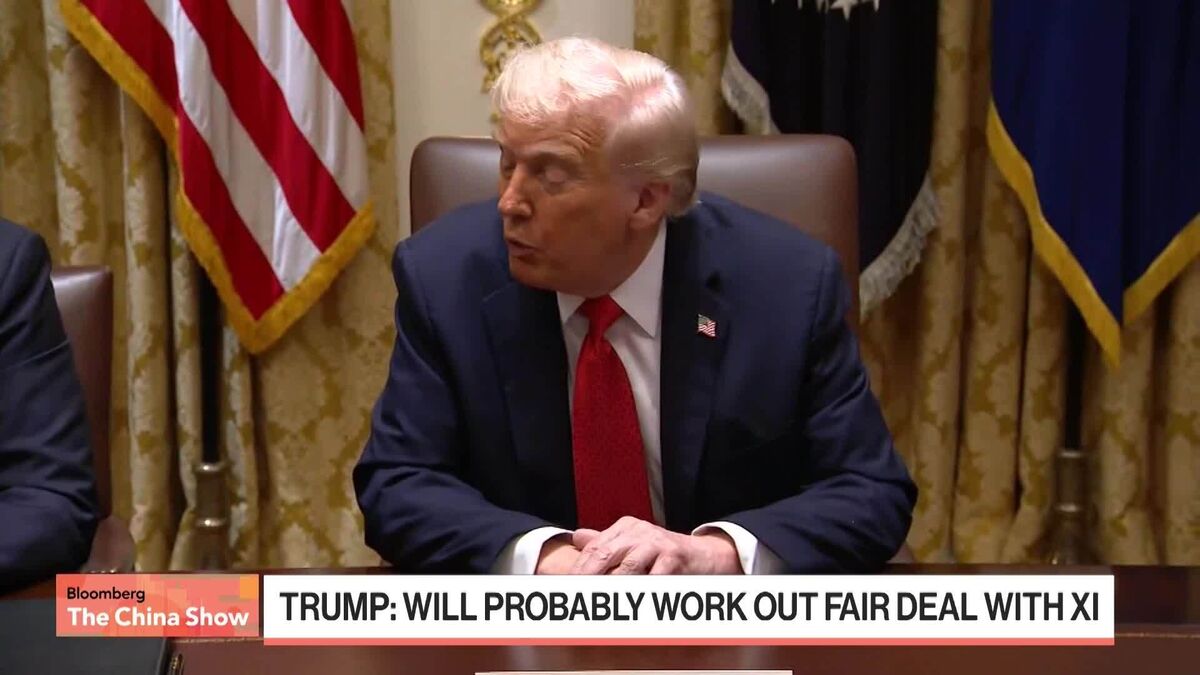

Fed’s Miran: Growth next year could hinge on how U.S.-China tensions are resolved - Fox Business

NeutralFinancial Markets

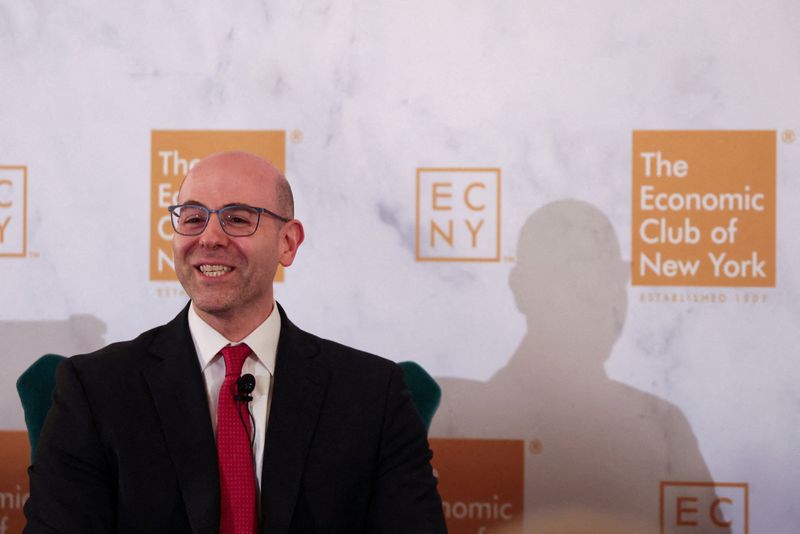

Fed official Miran has indicated that the economic growth of the United States next year may significantly depend on the resolution of ongoing tensions with China. This is important because U.S.-China relations play a crucial role in global trade and economic stability, and any developments in these tensions could have far-reaching implications for businesses and consumers alike.

— Curated by the World Pulse Now AI Editorial System