'It's a new common sense' Oxfam calls on governments to do more to tax the rich

PositiveFinancial Markets

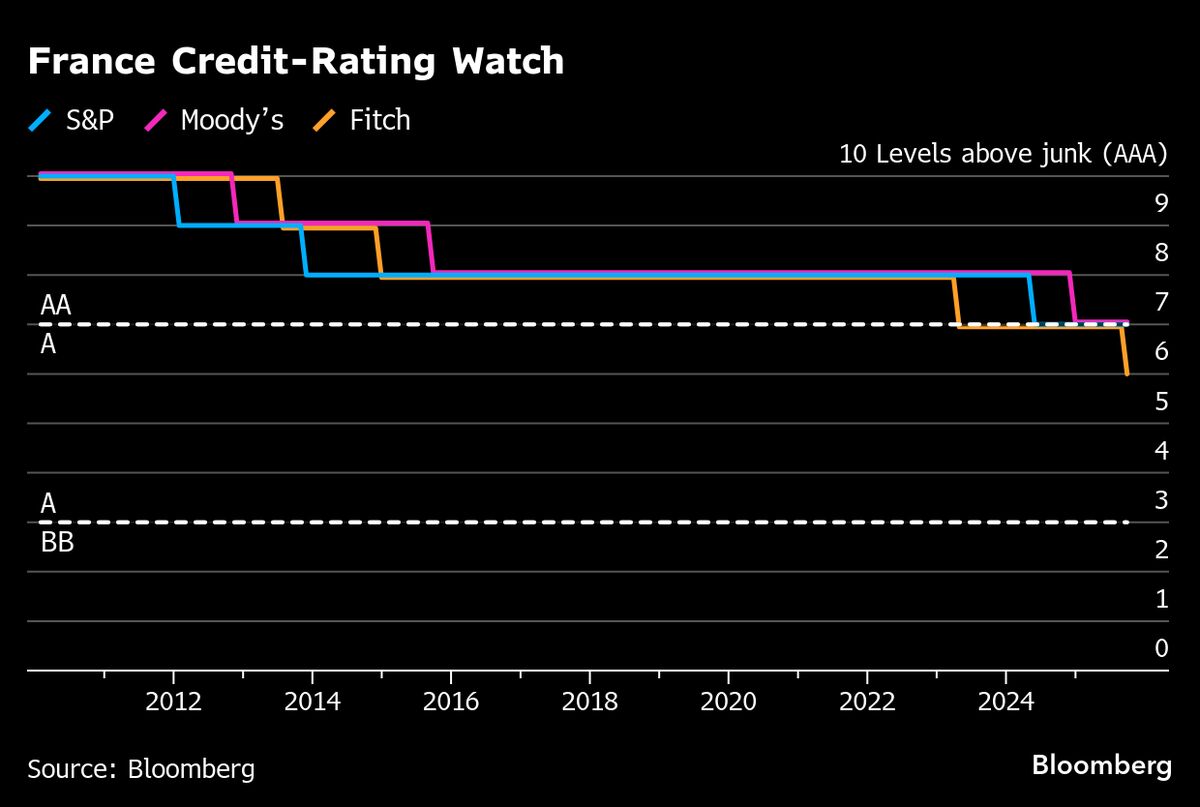

Oxfam is urging governments to reconsider wealth taxes, highlighting the stark reality that the richest 1% possess more wealth than the bottom 95% combined. Susana Ruiz, Oxfam's Tax Policy Lead, emphasizes that taxing the wealthy is becoming a necessary approach in today's economic landscape. This call for action is particularly relevant in France, where the debate over wealth taxation is intensifying. Additionally, concerns are being raised about Elon Musk's Starlink and its potential role in facilitating online scams in Southeast Asia, adding another layer to the discussion about corporate responsibility.

— Curated by the World Pulse Now AI Editorial System