Why gold and stocks are partying together

PositiveFinancial Markets

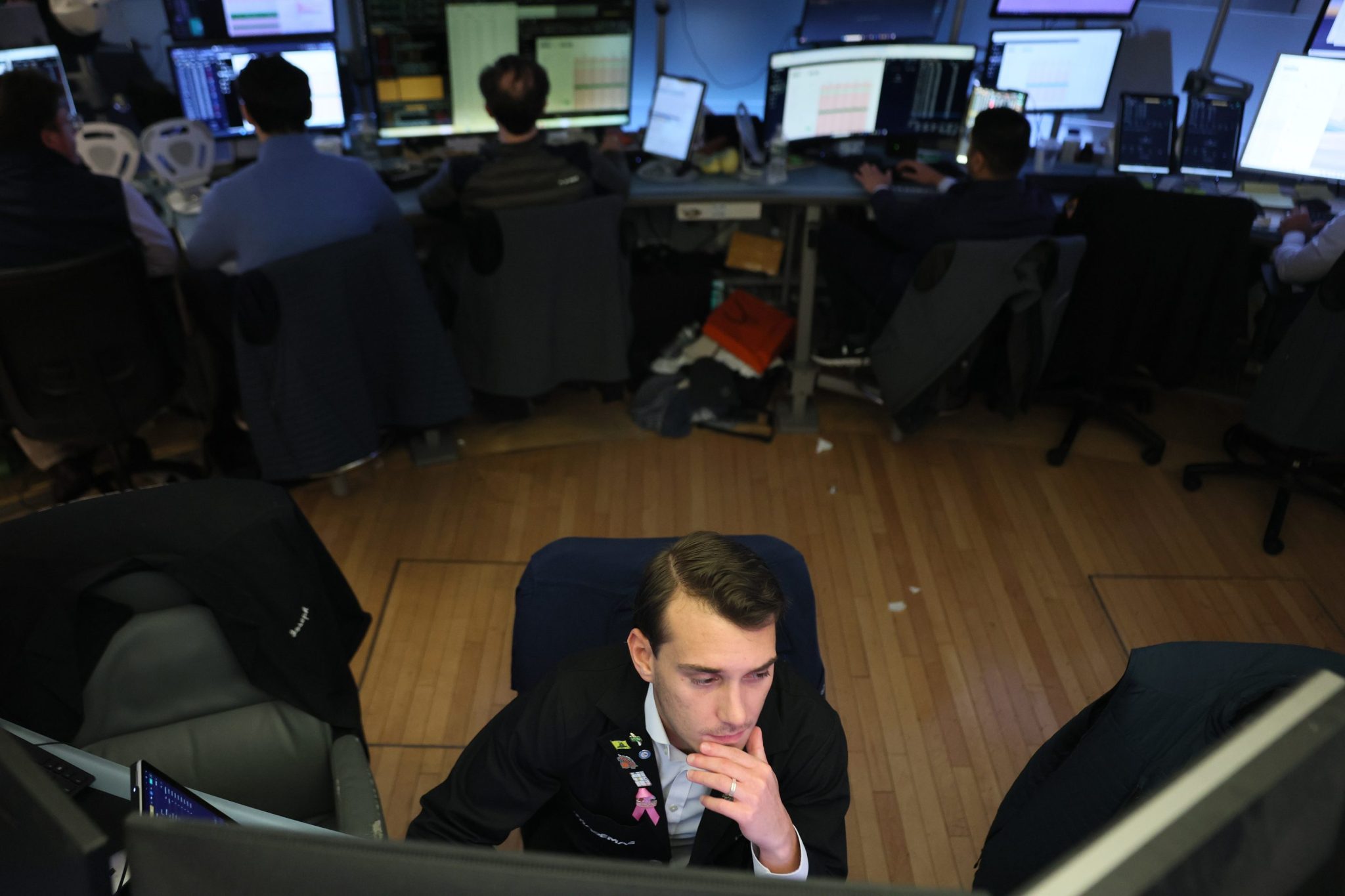

Recent trends show that gold and stocks are experiencing a simultaneous rise, which is unusual but significant. This connection suggests a unique market dynamic where both assets are thriving together, indicating investor confidence and a robust economy. Understanding this relationship can help investors make informed decisions about their portfolios.

— Curated by the World Pulse Now AI Editorial System