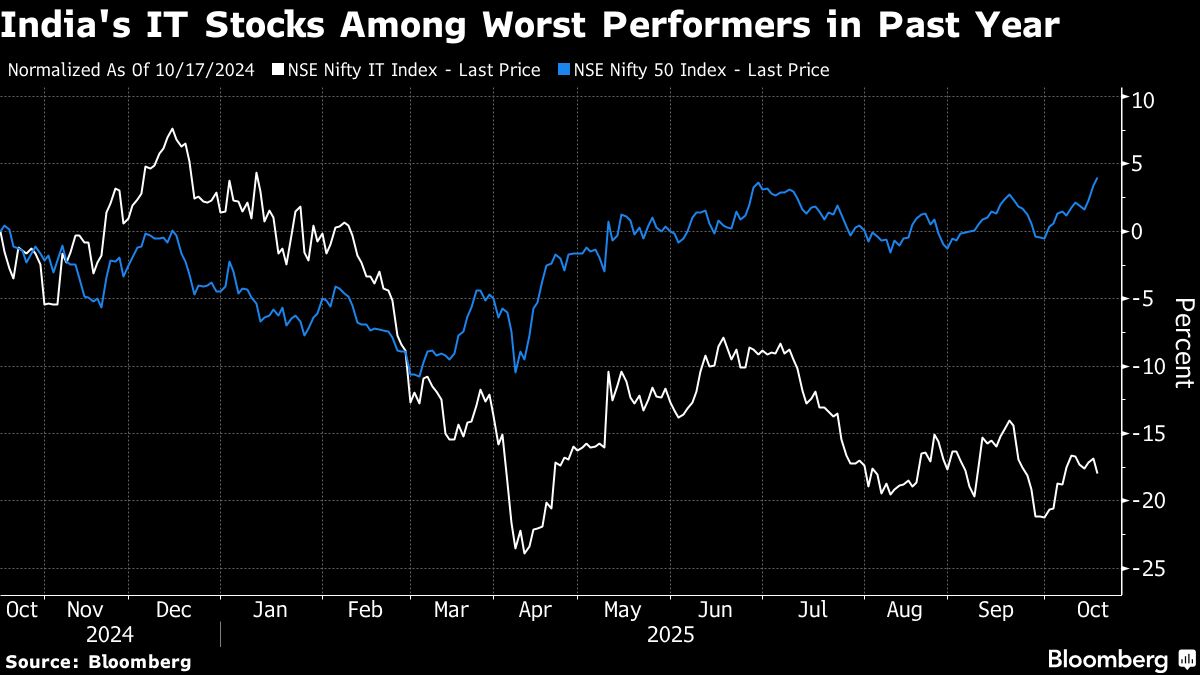

Pain Persists for India IT Stocks on Weak Outlook, Spending Cuts

NegativeFinancial Markets

India's IT stocks are facing ongoing challenges as recent second-quarter earnings from software exporters reveal a cautious outlook. Investors are worried about sluggish client spending and global uncertainties, which are impacting the sector's performance. This situation matters because it highlights the vulnerabilities in the Indian IT industry, which is a significant contributor to the country's economy.

— Curated by the World Pulse Now AI Editorial System