Nvidia partners with DOE, US firms to build national AI infrastructure

PositiveFinancial Markets

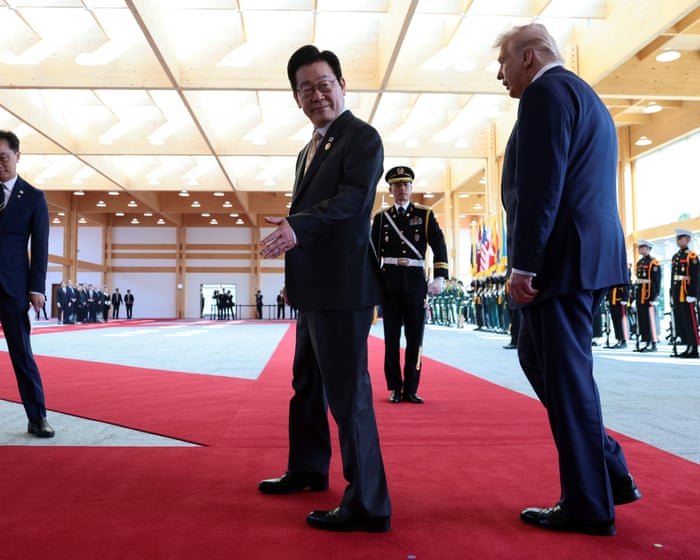

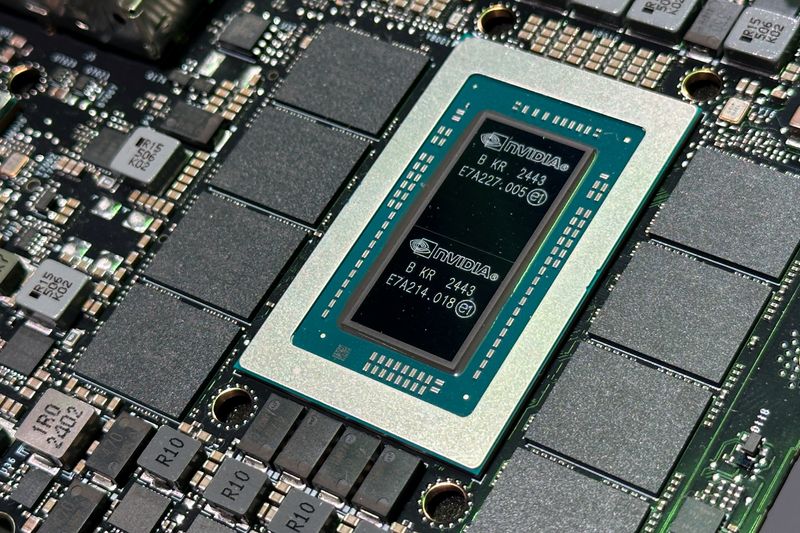

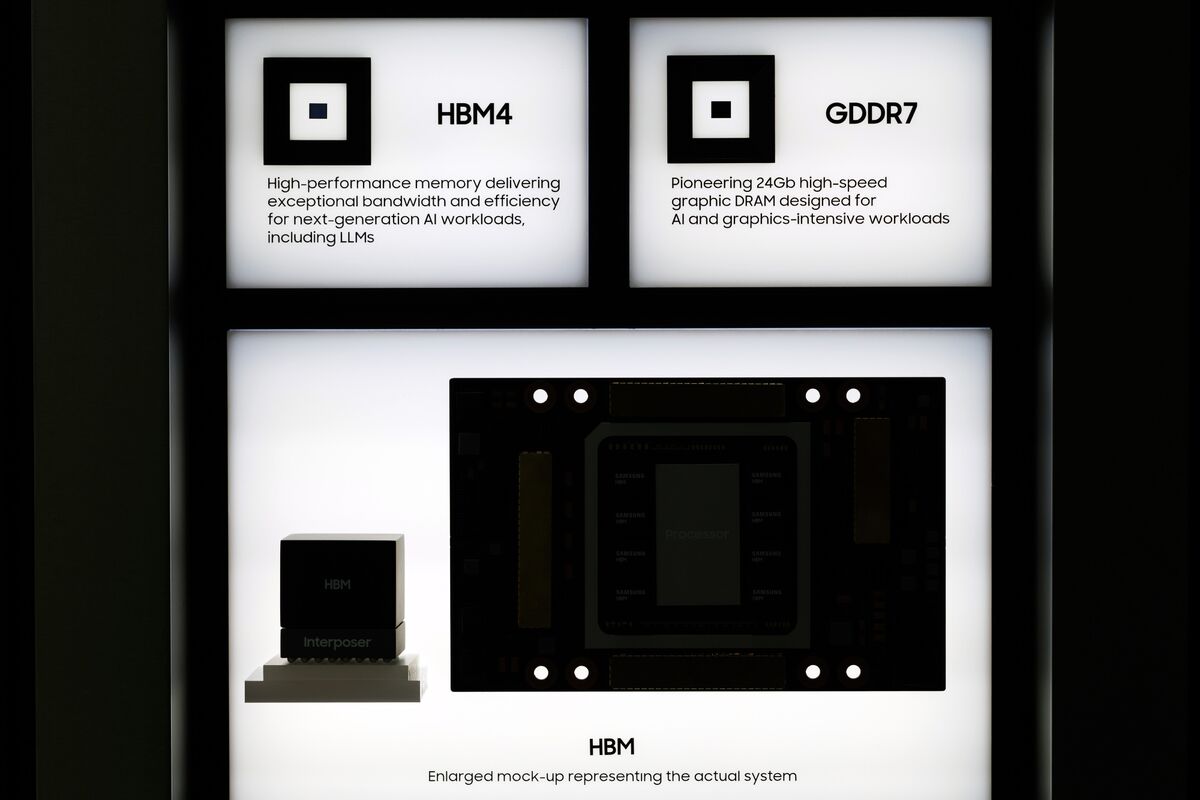

Nvidia has teamed up with the Department of Energy and several U.S. firms to create a national AI infrastructure, marking a significant step in advancing artificial intelligence technology. This partnership aims to enhance the country's capabilities in AI, which is crucial for various sectors, including healthcare, energy, and transportation. By pooling resources and expertise, they hope to drive innovation and maintain the U.S.'s competitive edge in the global tech landscape.

— Curated by the World Pulse Now AI Editorial System