Asia Set for Cautious Open After AI-Driven Rally: Markets Wrap

PositiveFinancial Markets

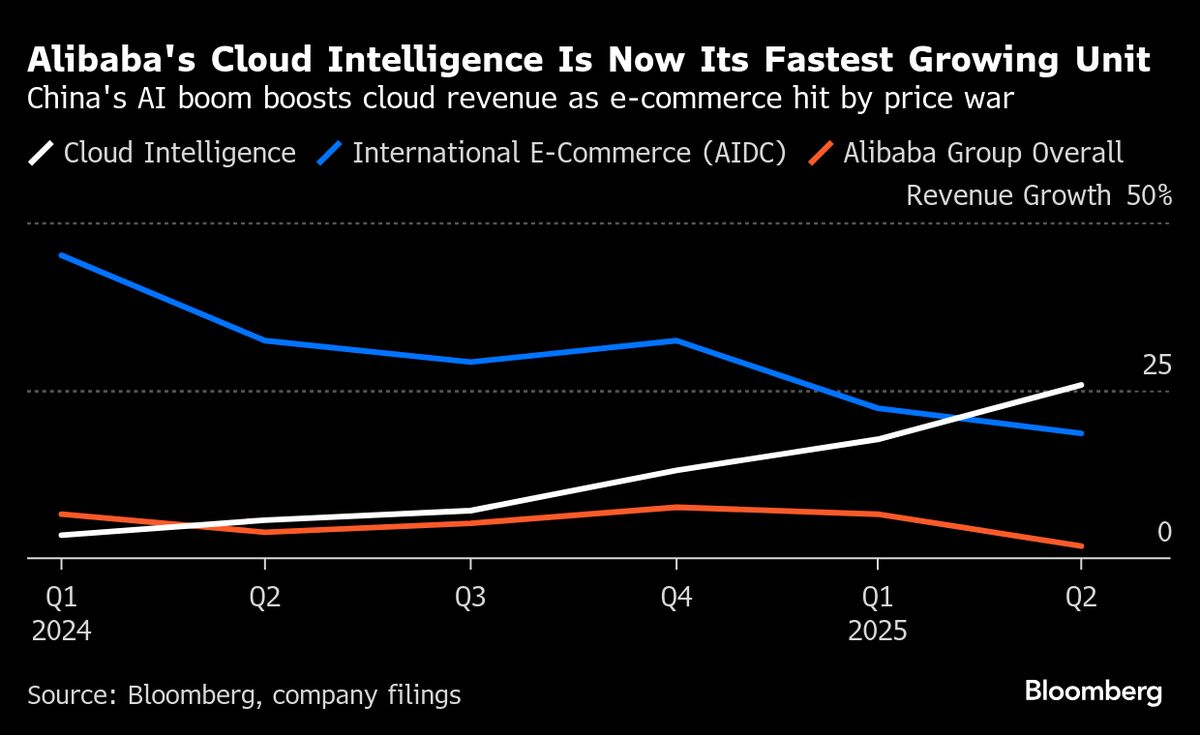

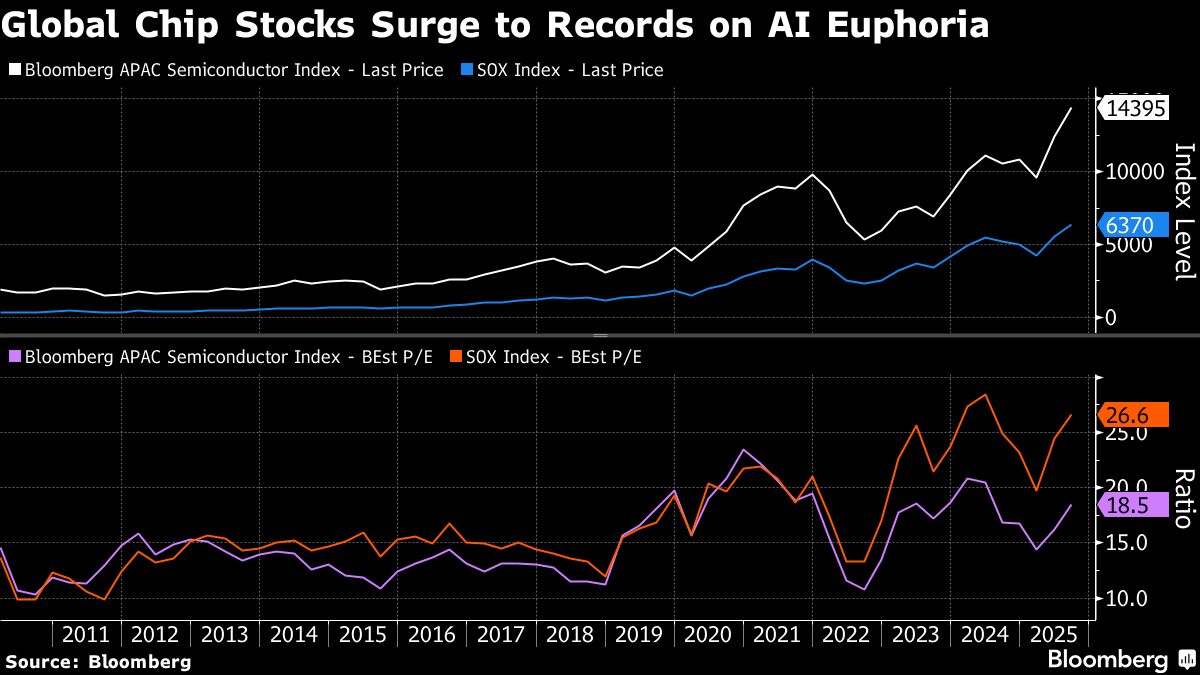

Asian stocks are poised for a mixed opening following a surge in US equities driven by optimism surrounding artificial intelligence. This rally highlights the growing influence of AI on market trends and investor sentiment, suggesting that technology continues to play a pivotal role in shaping economic landscapes.

— Curated by the World Pulse Now AI Editorial System