Investing Heavily in AI as Models Improve: GoDaddy CEO

PositiveFinancial Markets

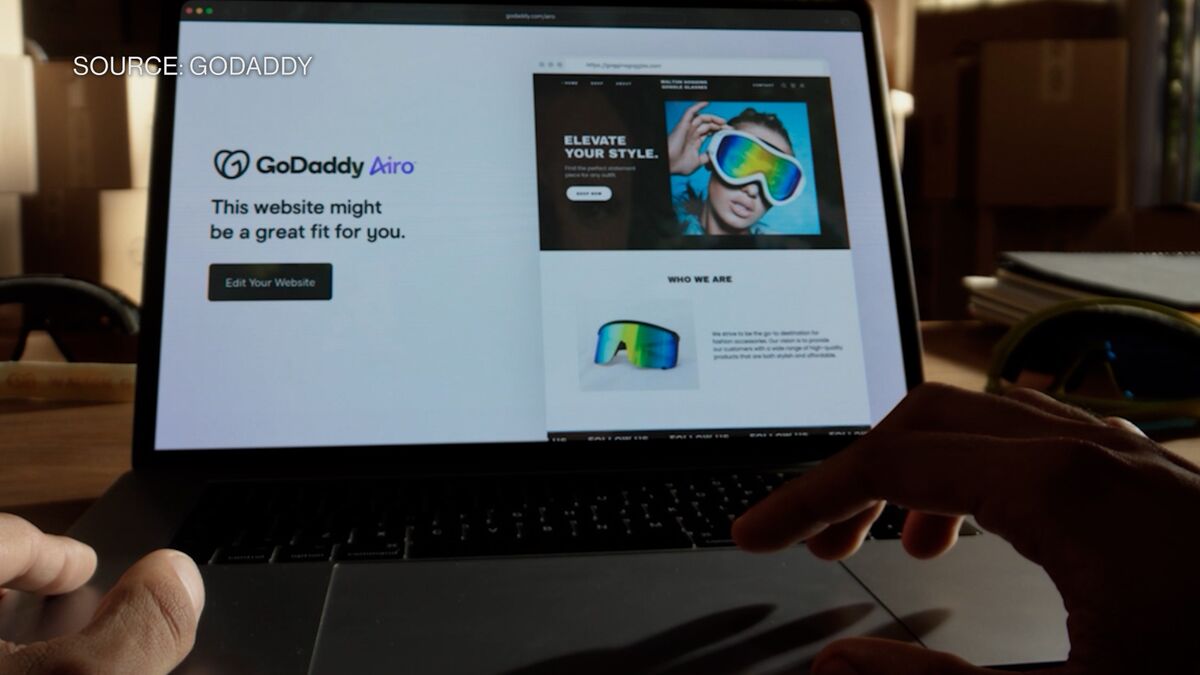

GoDaddy's CEO, Aman Bhutani, has announced an ambitious plan to transform the company through generative AI tools. By the end of this year, GoDaddy aims for 70% of its code to be AI-generated, showcasing a significant shift in how the company operates. This move not only highlights the growing importance of AI in the tech industry but also positions GoDaddy as a leader in innovation, potentially enhancing its services and customer experience.

— Curated by the World Pulse Now AI Editorial System