Europe’s patchwork of regulations is holding investors back, says German banking head

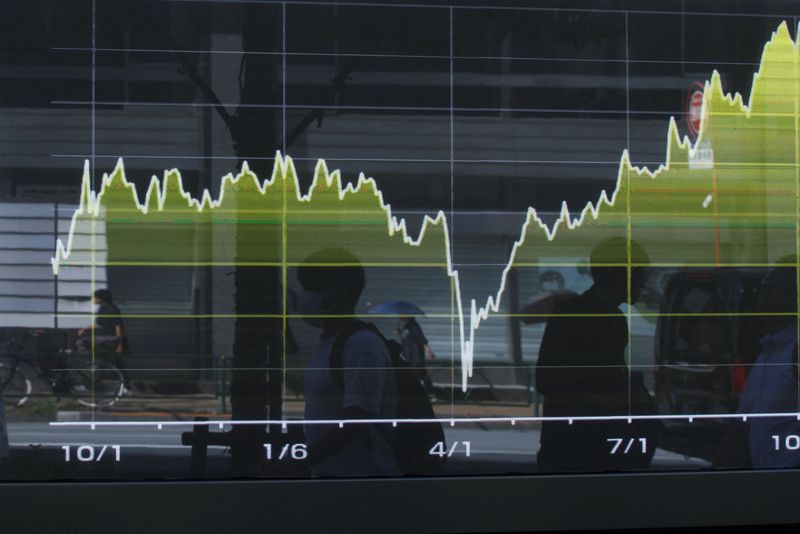

NegativeFinancial Markets

The head of Germany's banking sector has expressed concerns that Europe's inconsistent regulatory framework is hindering investment opportunities. This patchwork of regulations creates uncertainty for investors, making it difficult for them to navigate the market effectively. Addressing these regulatory challenges is crucial for fostering a more attractive investment environment in Europe, which could ultimately benefit the economy.

— Curated by the World Pulse Now AI Editorial System