Do Xi-Trump talks buy China more time to manage its decoupling?

NeutralFinancial Markets

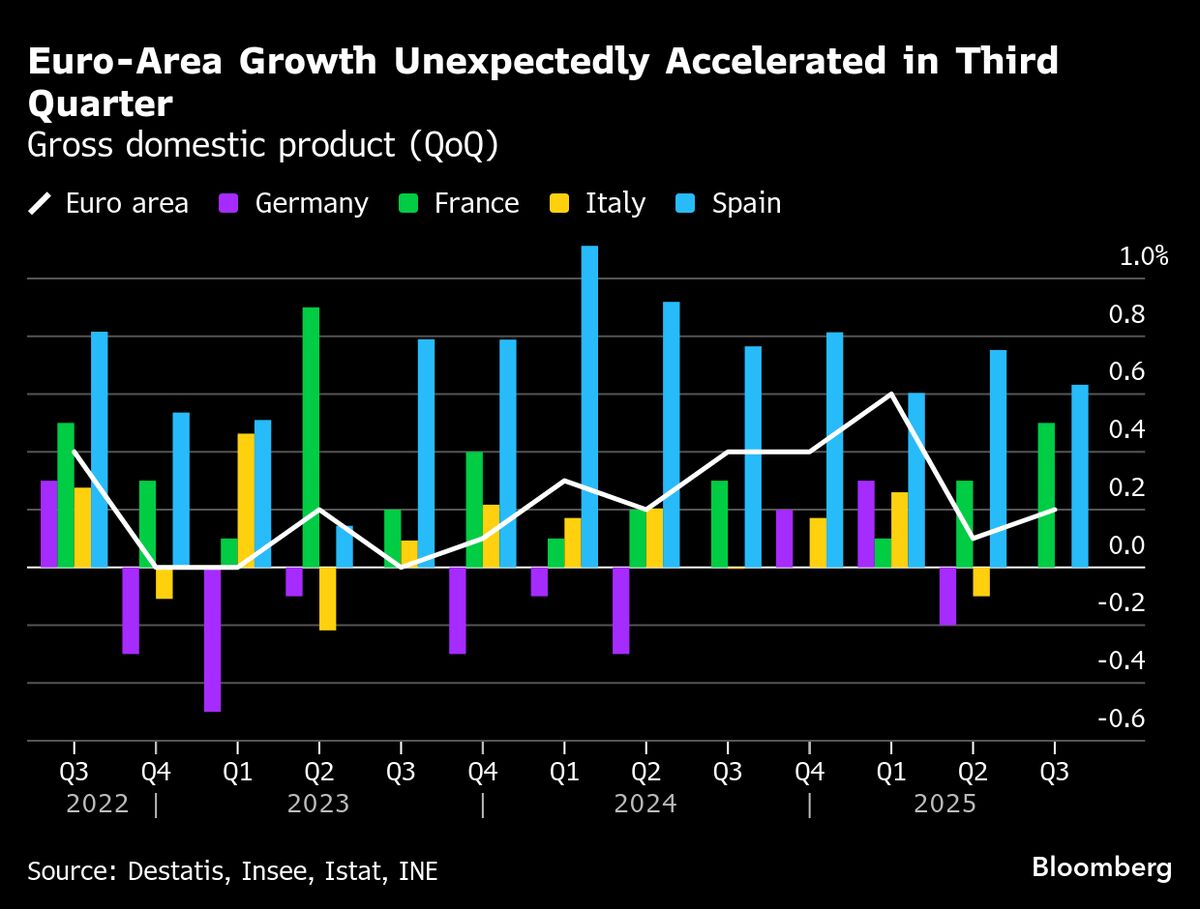

Recent discussions between Xi Jinping and Donald Trump have sparked interest in how these talks might influence China's economic decoupling from the United States. As both leaders navigate complex trade relationships, the outcome of their conversations could provide China with additional time to strategize its economic policies. This matters because the dynamics of US-China relations have significant implications for global trade and economic stability.

— Curated by the World Pulse Now AI Editorial System