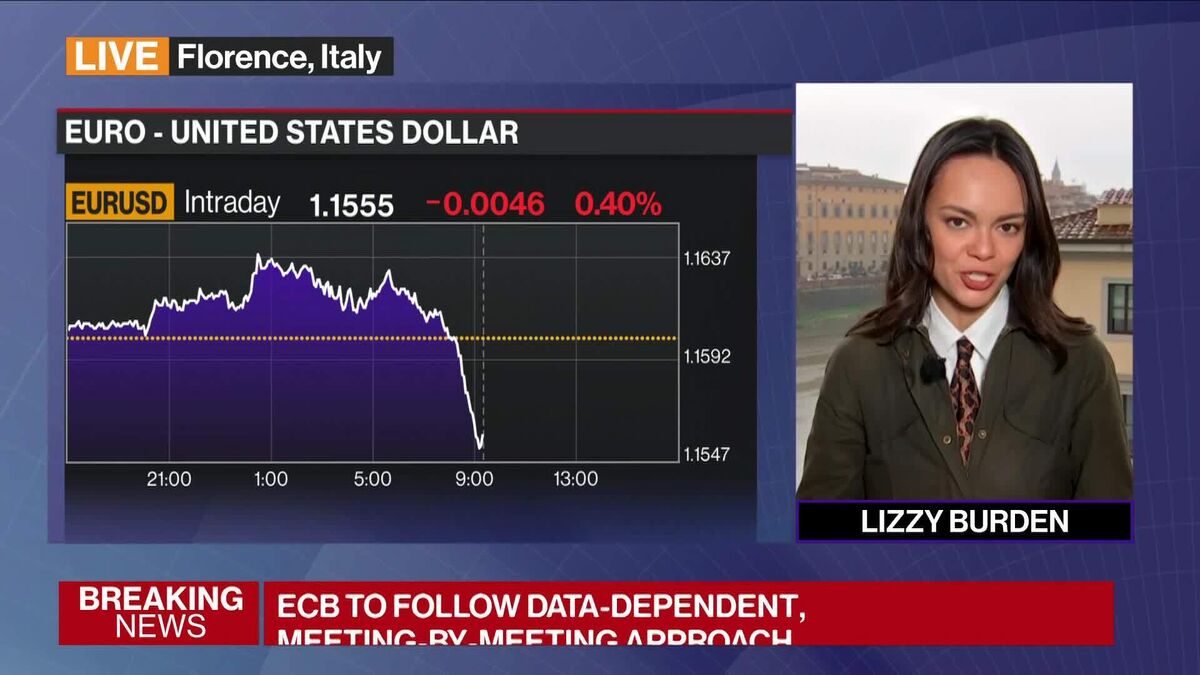

FTSE 100 winning streak ends as WPP shares hit lowest level since 1998; ECB holds rates at 2% - business live

NegativeFinancial Markets

The FTSE 100's winning streak has come to an end as WPP shares plummet to their lowest level since 1998, dropping about 14.5%. This decline raises concerns about potential job losses under the new leadership of Cindy Rose, who is conducting a strategic review to tackle the company's poor performance. The situation is significant as it reflects broader challenges in the advertising sector and could impact investor confidence in the market.

— Curated by the World Pulse Now AI Editorial System