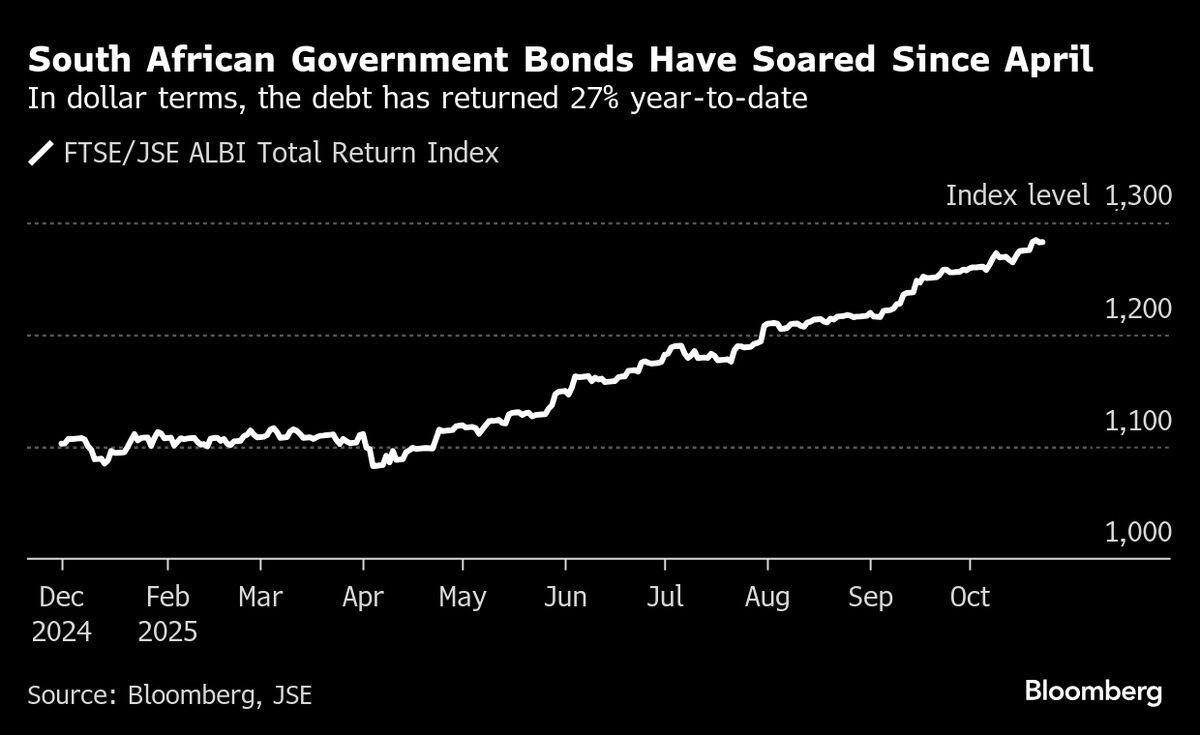

BlackRock Backs South African Bonds Amid US Debt Concerns

PositiveFinancial Markets

BlackRock's endorsement of South African local-currency government bonds highlights a growing trend among investors looking for alternatives to US Treasuries. With concerns about a weakening dollar and increasing government debt in the US, these bonds are gaining traction as a viable investment option. This shift not only reflects confidence in South Africa's economic stability but also presents opportunities for diversification in investment portfolios.

— Curated by the World Pulse Now AI Editorial System