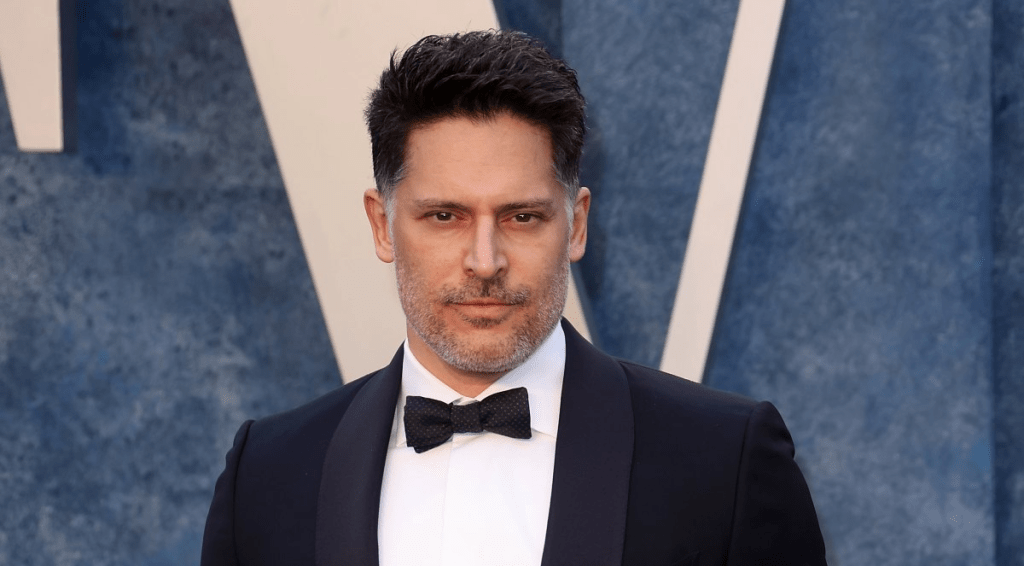

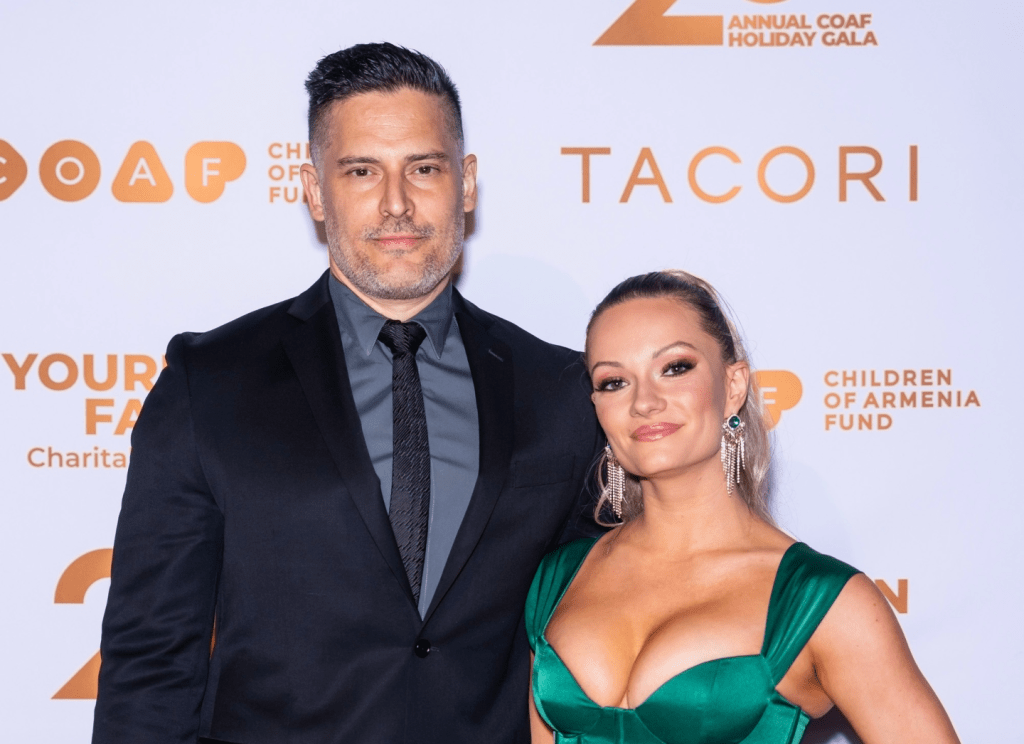

Joe Manganiello’s Engagement Could Supercharge His Brand—and Caitlin O’Connor’s—After a Post-Divorce Reset

PositiveFinancial Markets

Joe Manganiello's recent engagement to Caitlin O'Connor is not just a personal milestone; it could significantly boost both of their brands in the entertainment industry. Following Manganiello's post-divorce reset, this new chapter in his life is likely to attract media attention and public interest, enhancing their visibility and opportunities. This engagement symbolizes a fresh start for Manganiello and could lead to exciting collaborations and projects for both stars.

— Curated by the World Pulse Now AI Editorial System