Asia FX, dollar flat amid US govt shutdown risks; RBA rate decision ahead

NeutralFinancial Markets

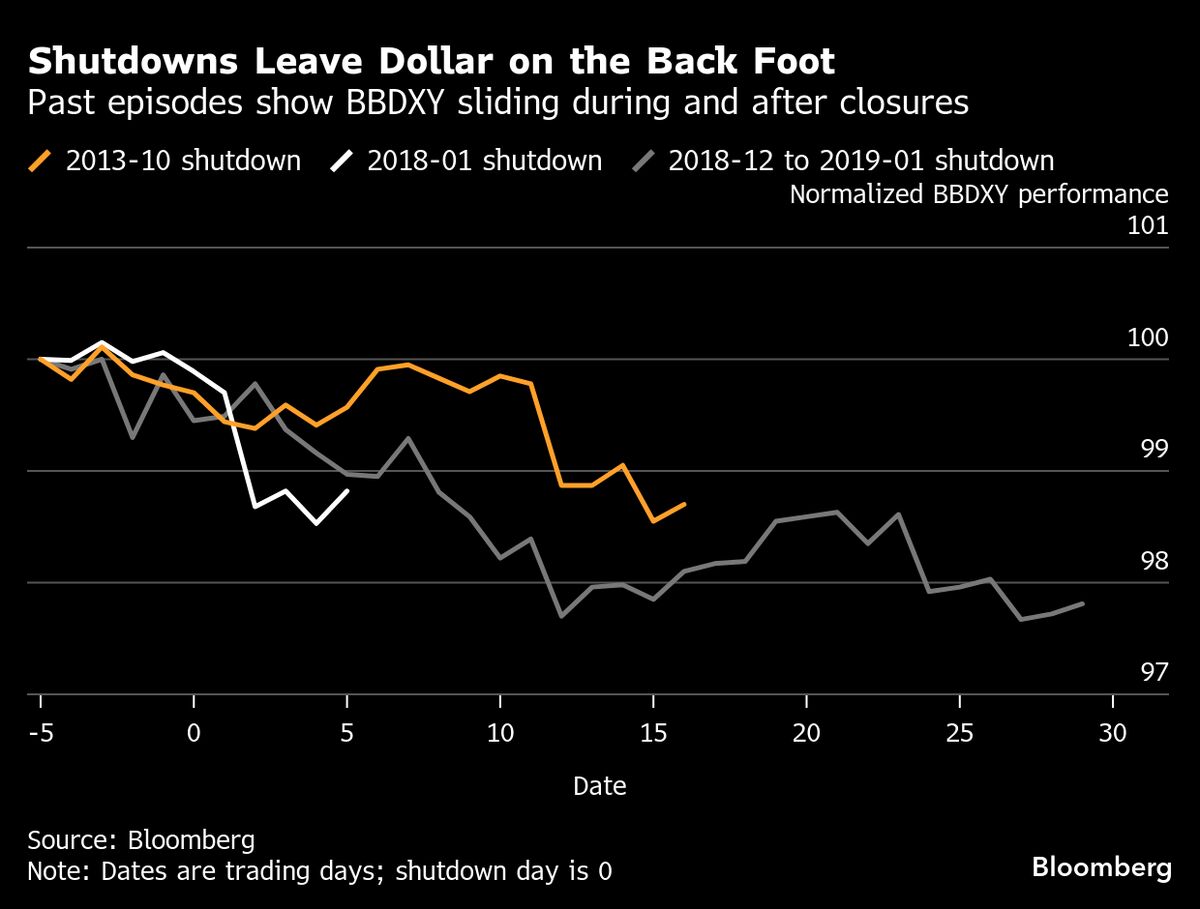

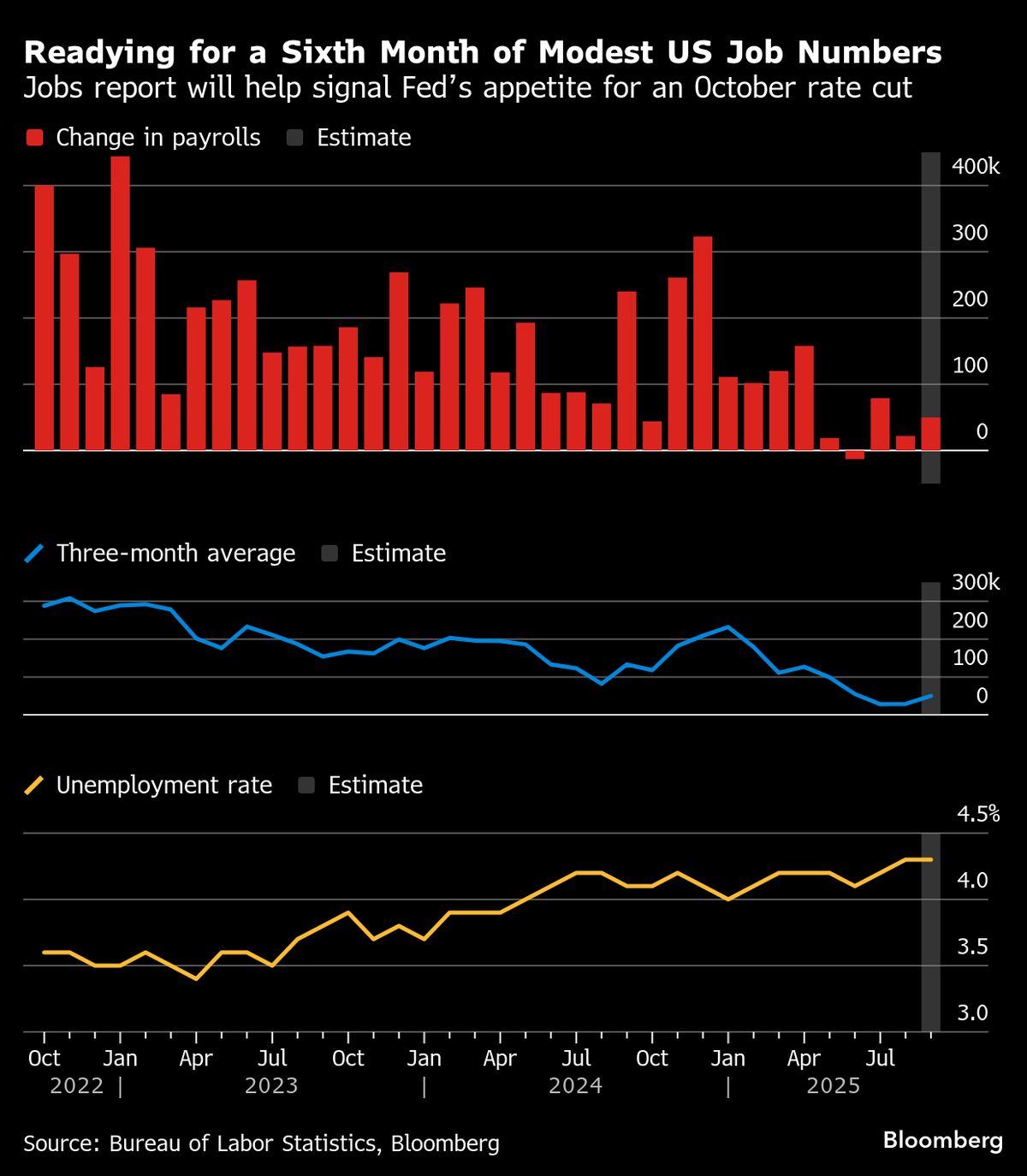

The Asian foreign exchange market is experiencing stability as the dollar remains flat amidst concerns over a potential US government shutdown. Investors are closely monitoring the situation, particularly with the Reserve Bank of Australia's rate decision approaching. This is significant as it could influence market trends and economic forecasts in the region.

— Curated by the World Pulse Now AI Editorial System