Qatar's Finance Minister on Upcoming Islamic Bond Issuance

PositiveFinancial Markets

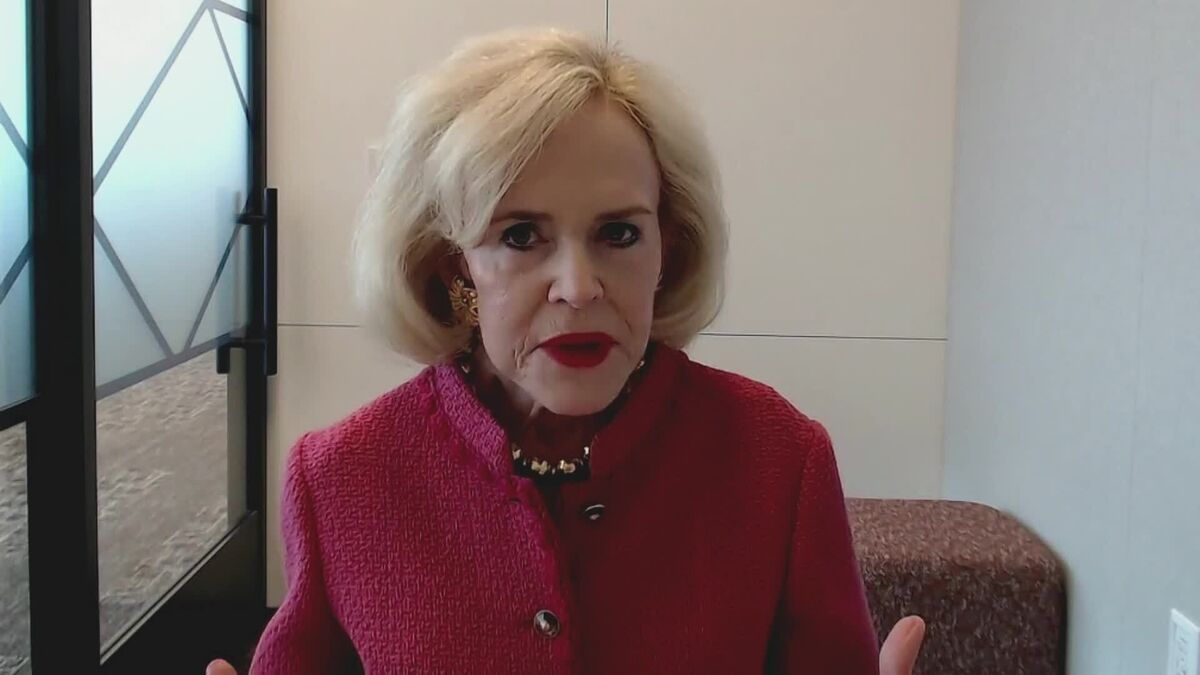

Qatar's Finance Minister Ali Al-Kuwari recently announced plans to issue Islamic bonds within the next few weeks, following similar moves by neighboring countries like Saudi Arabia and Bahrain. This initiative is significant as it reflects Qatar's commitment to diversifying its financial instruments and tapping into the growing demand for Islamic finance, which could enhance its economic stability and attract more investors.

— Curated by the World Pulse Now AI Editorial System