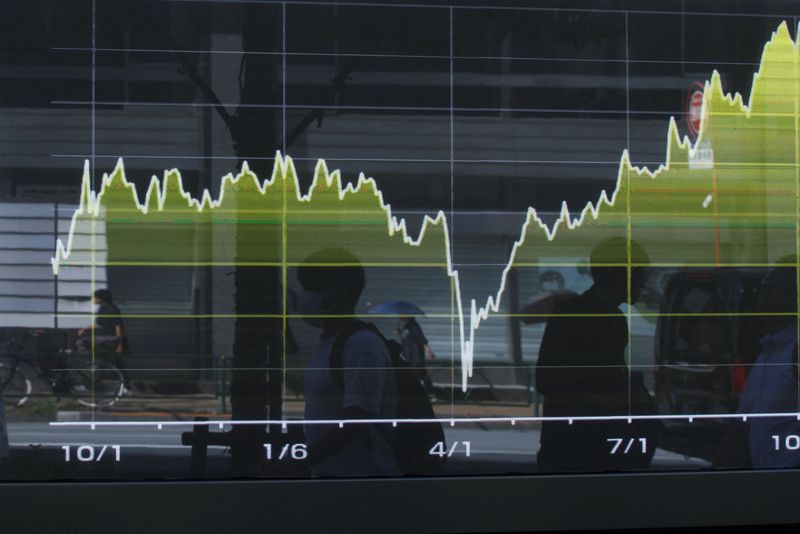

Global equity funds draw fourth weekly inflow on hopes of Fed rate cut

PositiveFinancial Markets

Global equity funds have seen their fourth consecutive week of inflows, driven by optimism surrounding potential interest rate cuts from the Federal Reserve. This trend indicates that investors are becoming more confident in the market, as they anticipate a more favorable economic environment. Such inflows can lead to increased market stability and growth, making it a significant development for both investors and the broader economy.

— Curated by the World Pulse Now AI Editorial System