XRP ETF Countdown Heats up as SEC Filings Surge and Bulls Eye Breakout Rally

PositiveCryptocurrency

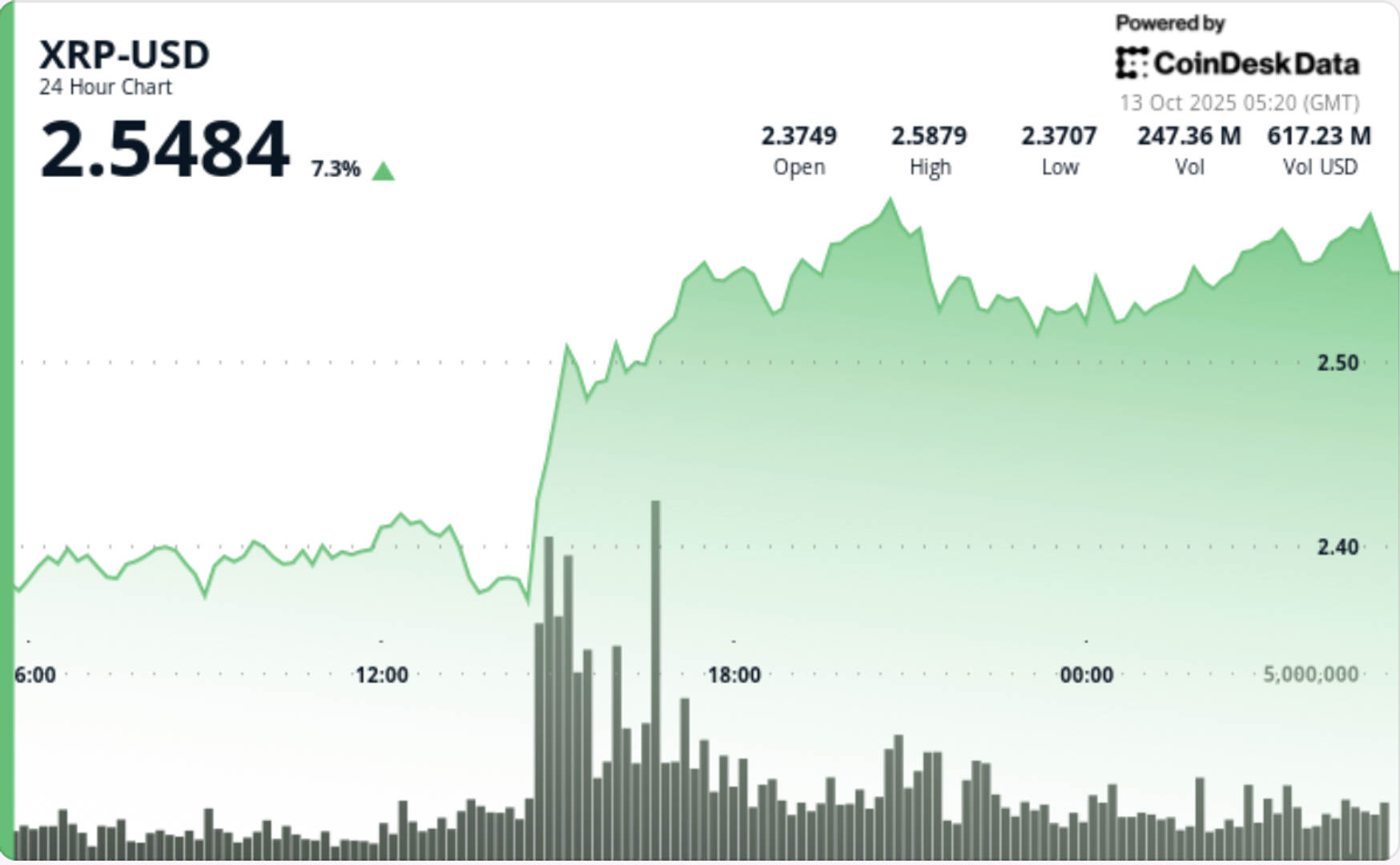

The excitement around XRP's potential ETF is building as the SEC sees a surge in filings, hinting at a possible breakthrough for cryptocurrency investors. This development is significant because it could pave the way for greater institutional investment in XRP, potentially driving its price up and increasing mainstream acceptance of cryptocurrencies.

— Curated by the World Pulse Now AI Editorial System