XRP’s 2017 Pattern Returns In 2025, Analyst Predicts Massive Rally

PositiveCryptocurrency

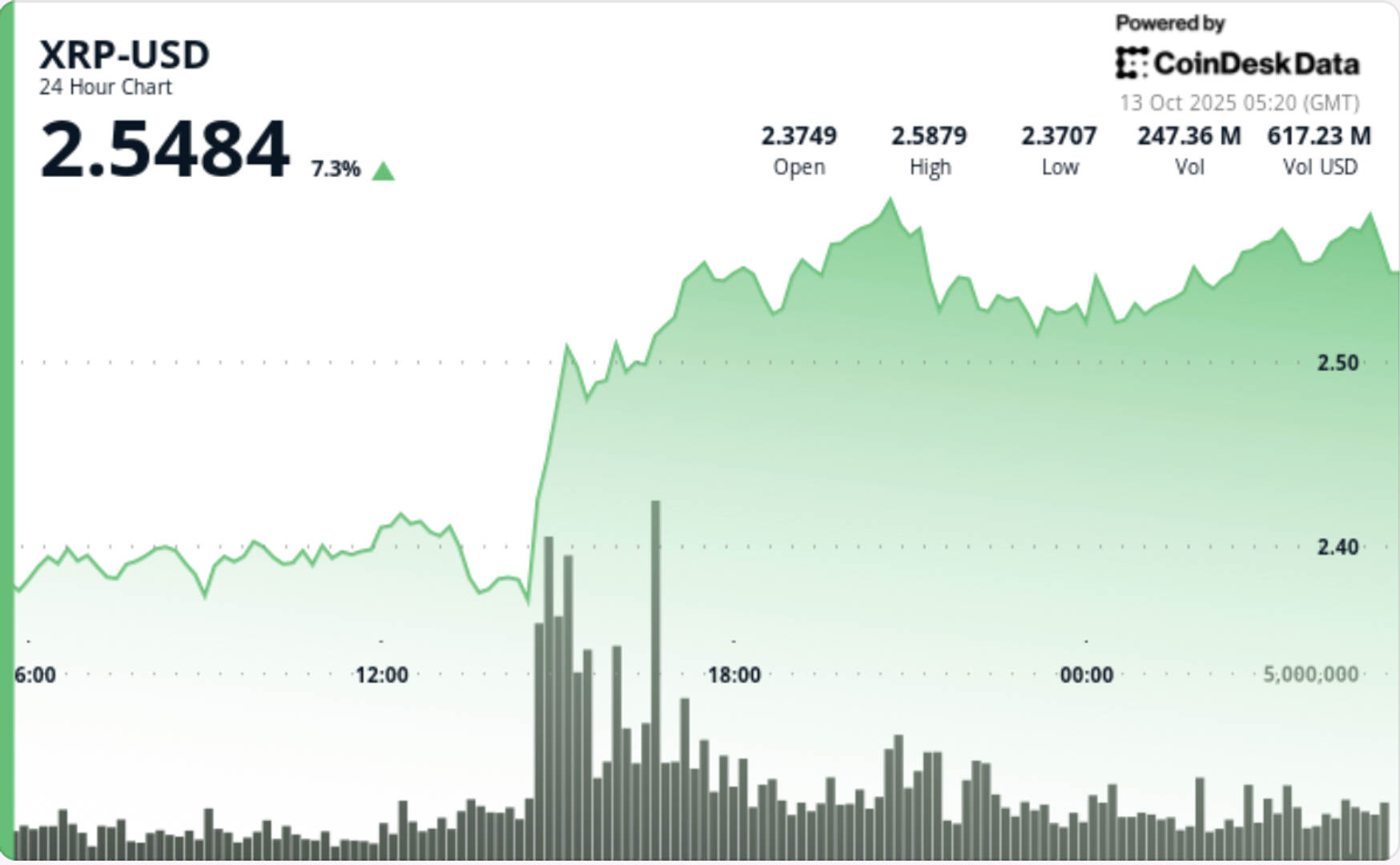

XRP has recently experienced significant price fluctuations, dropping to a low of $1.64 before bouncing back to $2.36, with trading volumes surging. A technical analyst notes that this price action mirrors a pattern from 2017, suggesting that XRP could be on the verge of a major rally. This is exciting news for investors and crypto enthusiasts, as it indicates potential growth in the cryptocurrency market.

— Curated by the World Pulse Now AI Editorial System