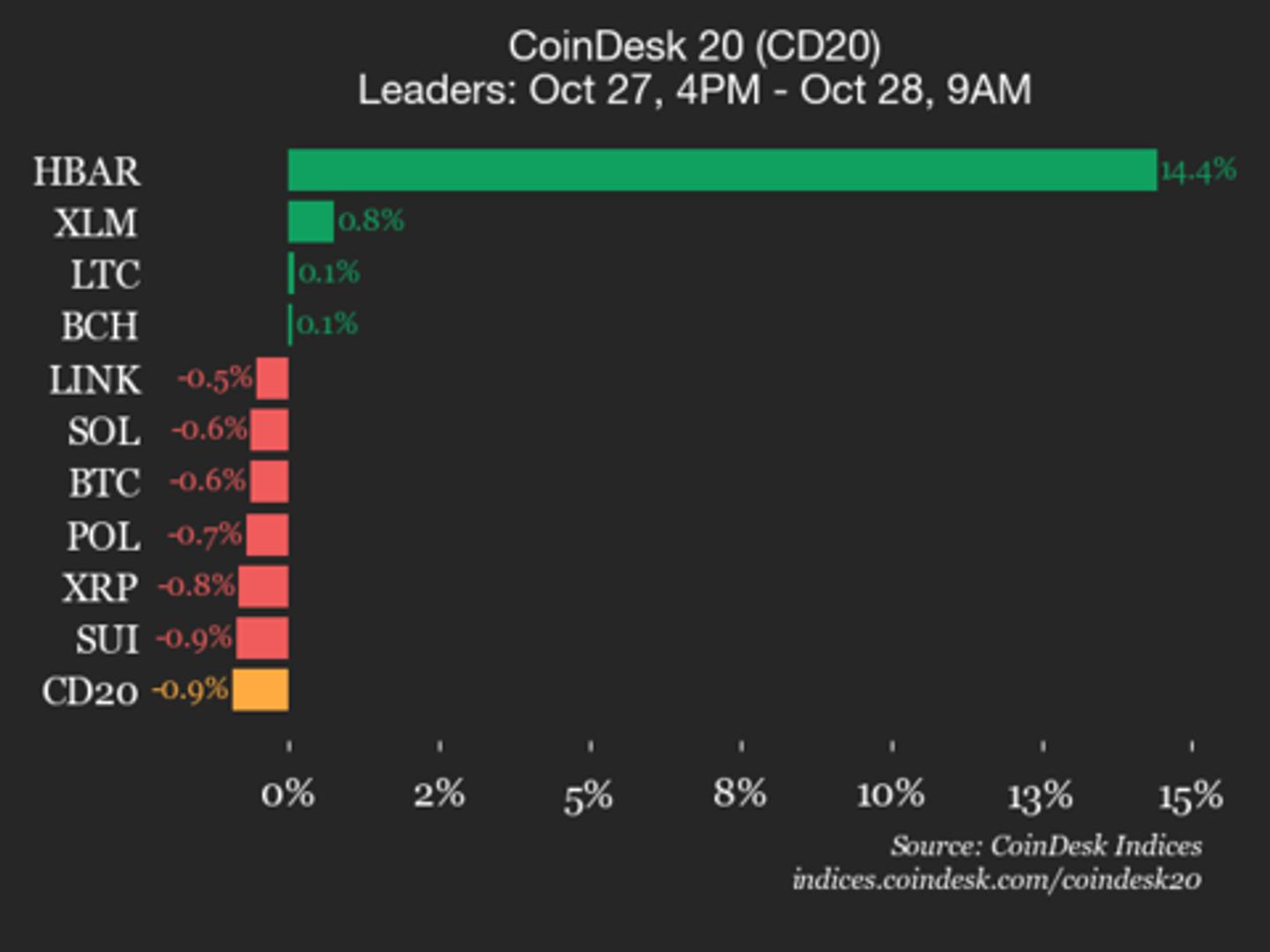

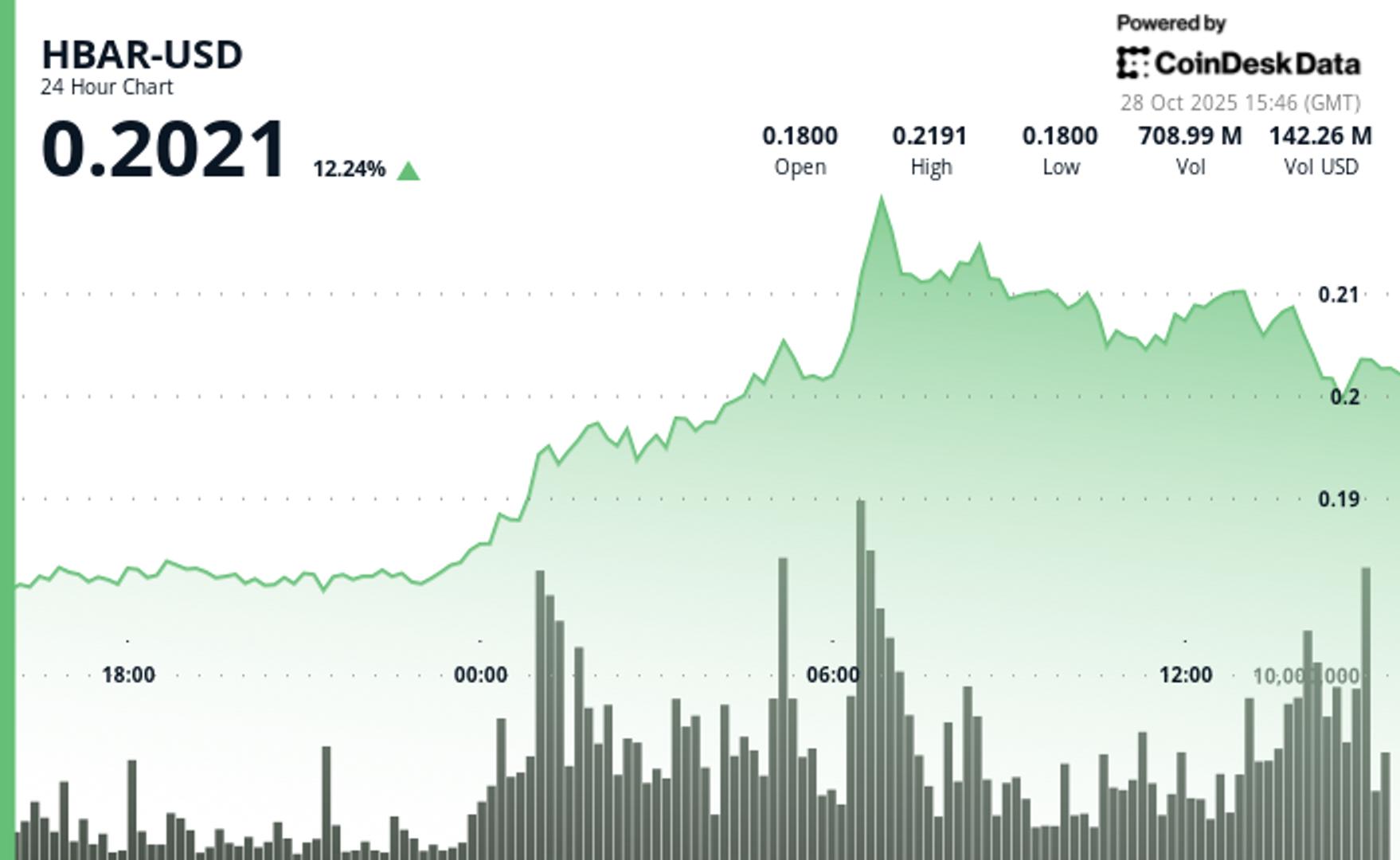

Hedera Jumps 25.7% Breaking Key Resistance as Spot ETF Launches

PositiveCryptocurrency

Hedera's HBAR token has surged by 25.7%, breaking through the crucial $0.20 resistance level, thanks to the launch of the Canary Capital HBAR ETF on the NYSE. This move is significant as it reflects growing institutional interest in cryptocurrencies, particularly with backing from established firms like BitGo. Such developments could pave the way for more mainstream adoption of digital assets.

— Curated by the World Pulse Now AI Editorial System