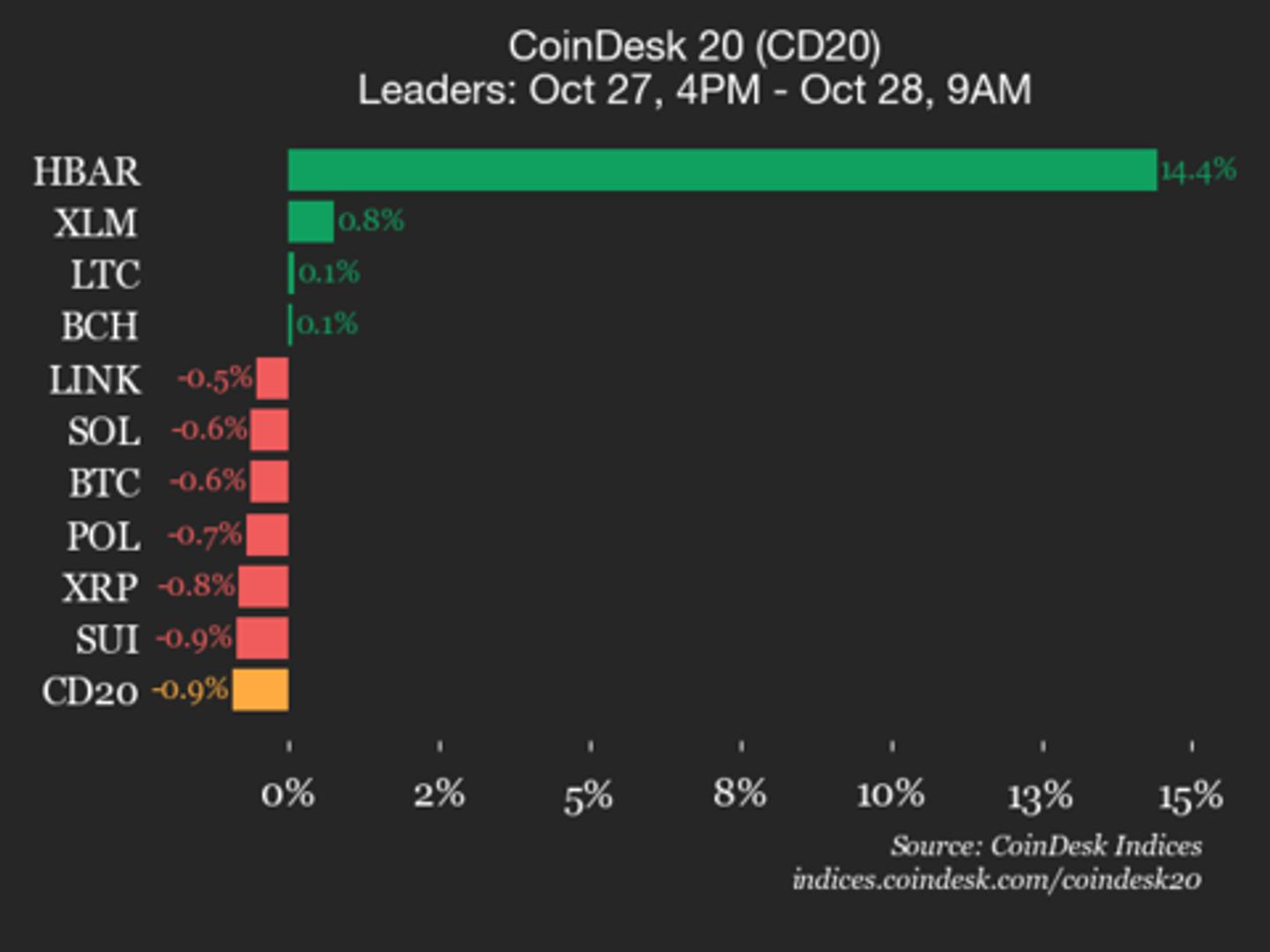

CoinDesk 20 Performance Update: Hedera (HBAR) Surges 14.4% While Index Trades Lower

PositiveCryptocurrency

Hedera (HBAR) has seen a remarkable surge of 14.4%, standing out in the latest CoinDesk 20 performance update, even as the broader index trades lower. This rise is significant as it highlights Hedera's growing strength and potential in the cryptocurrency market, attracting attention from investors and analysts alike. Such performance could indicate a shift in market dynamics, making it a noteworthy development for those following digital assets.

— Curated by the World Pulse Now AI Editorial System