MYX Finance integrates Chainlink data standard to power next-gen perps markets

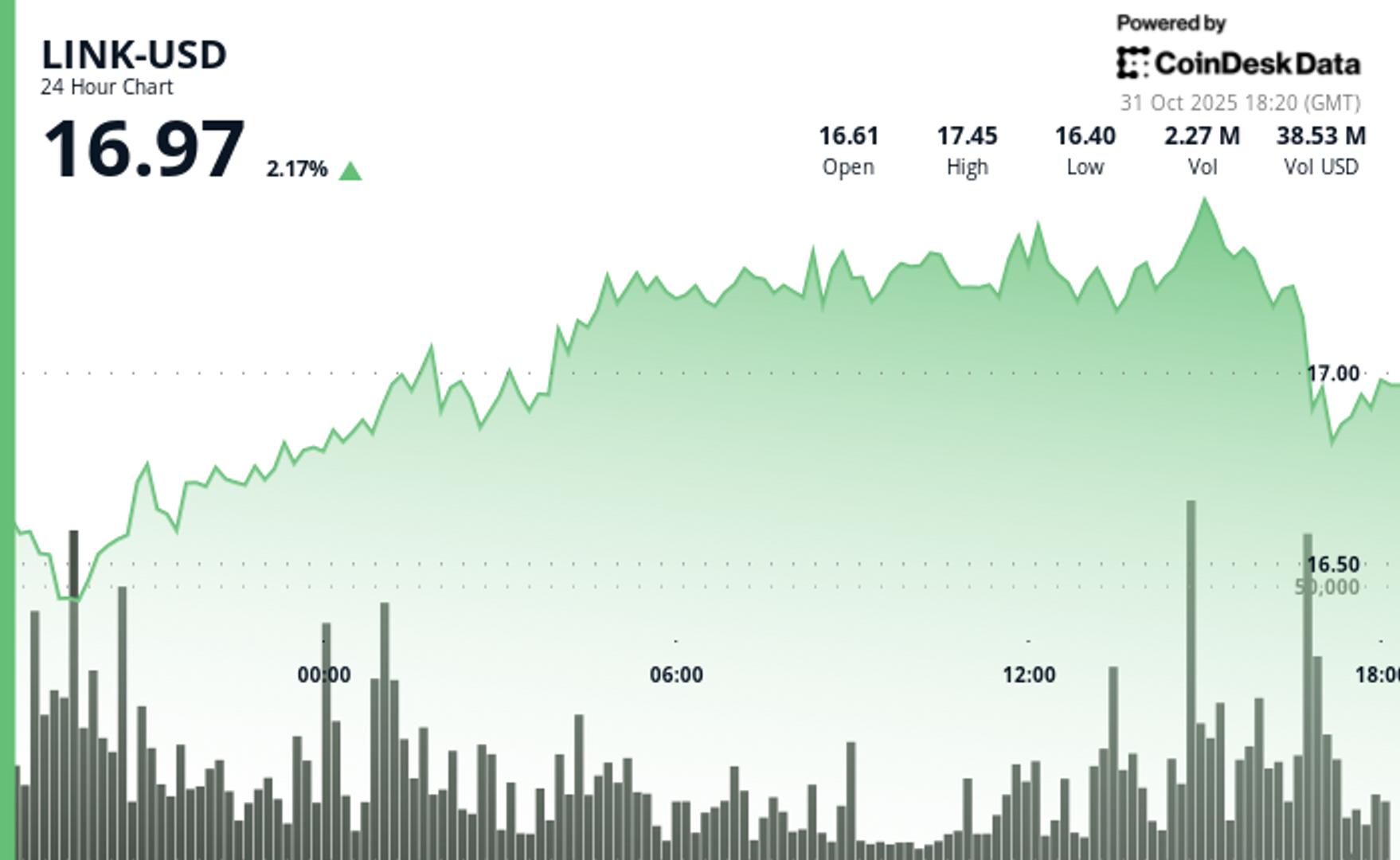

PositiveCryptocurrency

MYX Finance has made a significant leap by integrating Chainlink's data-standard services, enhancing its decentralized perpetual trading infrastructure. This integration allows MYX to provide real-time, verifiable market data, which is crucial for traders seeking transparency and reliability. As MYX builds an open and permissionless trading ecosystem, this move not only strengthens its platform but also sets a new standard for decentralized finance, making it an exciting development for the trading community.

— Curated by the World Pulse Now AI Editorial System