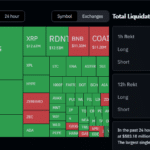

Green Shoots on China Lifts Crypto in Sunday Action

PositiveCryptocurrency

This weekend saw a positive shift in the crypto market as both Beijing and Washington took steps to ease trade tensions. This development is significant because it not only boosts investor confidence in cryptocurrencies but also suggests a potential stabilization in international relations, which could lead to a more favorable environment for digital assets.

— Curated by the World Pulse Now AI Editorial System