Can BTC And ETH Rebound After A $19B Liquidation Storm?

NeutralCryptocurrency

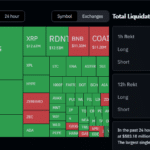

A recent selloff in the cryptocurrency market led to a staggering $19.37 billion in leveraged trades being liquidated within just 24 hours. This event has raised questions about the future of the two largest cryptocurrencies, Bitcoin (BTC) and Ethereum (ETH). As the market stabilizes, it's crucial to analyze how these digital assets are performing and whether they can recover from this significant downturn. Understanding their resilience in the face of macroeconomic pressures is vital for investors and enthusiasts alike.

— Curated by the World Pulse Now AI Editorial System