COAI Crypto Drops After Sprinting 100X: Is Chain Opera AI Run Finished?

NegativeCryptocurrency

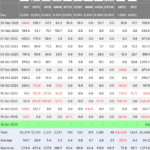

The recent surge of COAI, a cryptocurrency associated with Chain Opera AI, has taken a sharp downturn, plummeting over 52% in just one day after an impressive 100x increase. This dramatic drop highlights the volatility of the crypto market and serves as a reminder of the risks involved in such investments. As excitement fades and scrutiny increases, investors are left questioning the sustainability of such rapid gains, making it a crucial moment for those involved in the crypto space.

— Curated by the World Pulse Now AI Editorial System