Grok’s Best Crypto to Buy in Uptober Ahead of ETF Approval

PositiveCryptocurrency

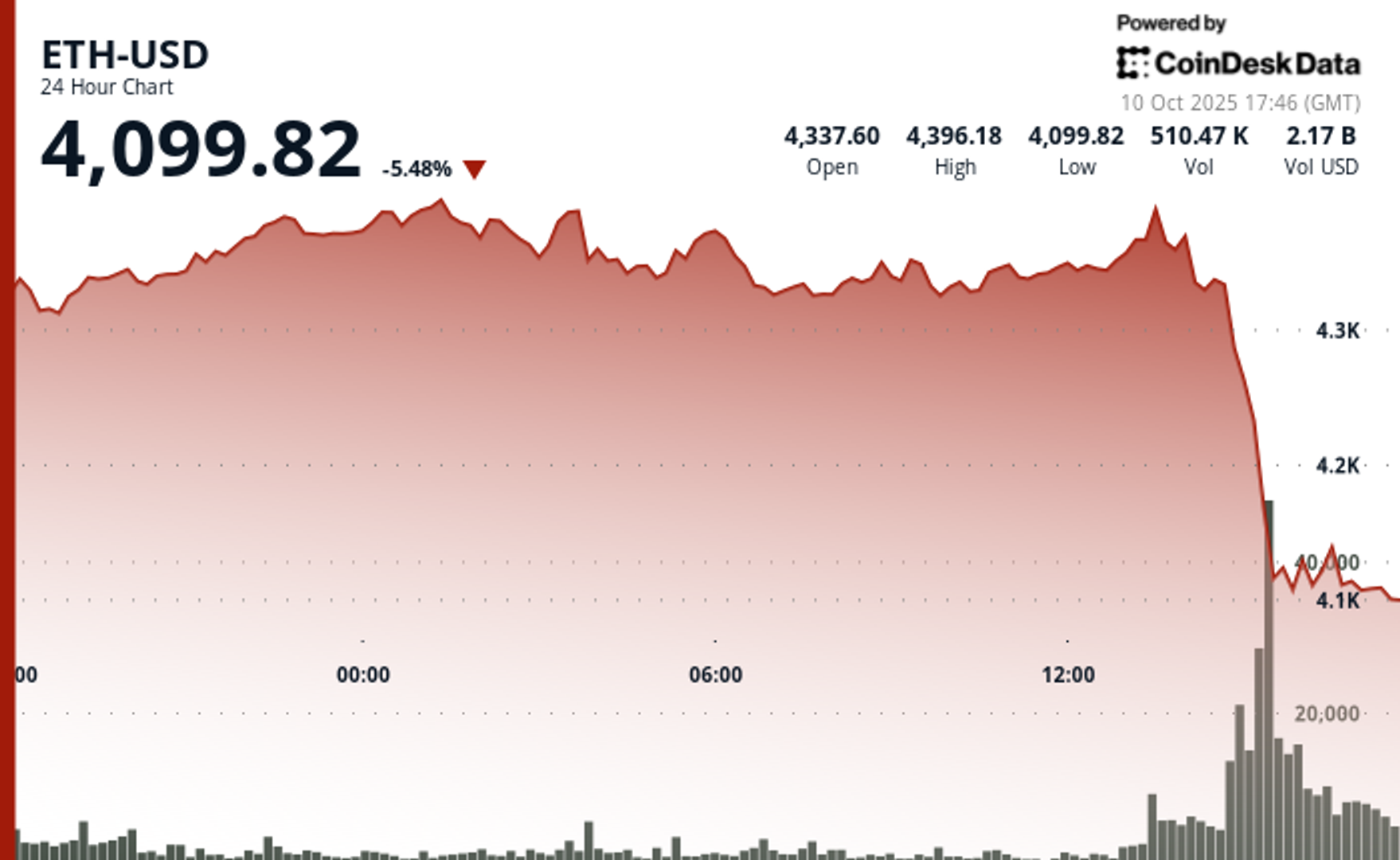

October is shaping up to be a monumental month for cryptocurrency as a record 16 ETF applications are due for SEC deadlines, marking it as the biggest ETF month in crypto history. The SEC's new listing standards are streamlining the approval process for spot crypto and altcoin ETFs, attracting significant institutional interest. This surge in activity could lead to increased market confidence and investment opportunities, making it an exciting time for crypto enthusiasts and investors alike.

— Curated by the World Pulse Now AI Editorial System