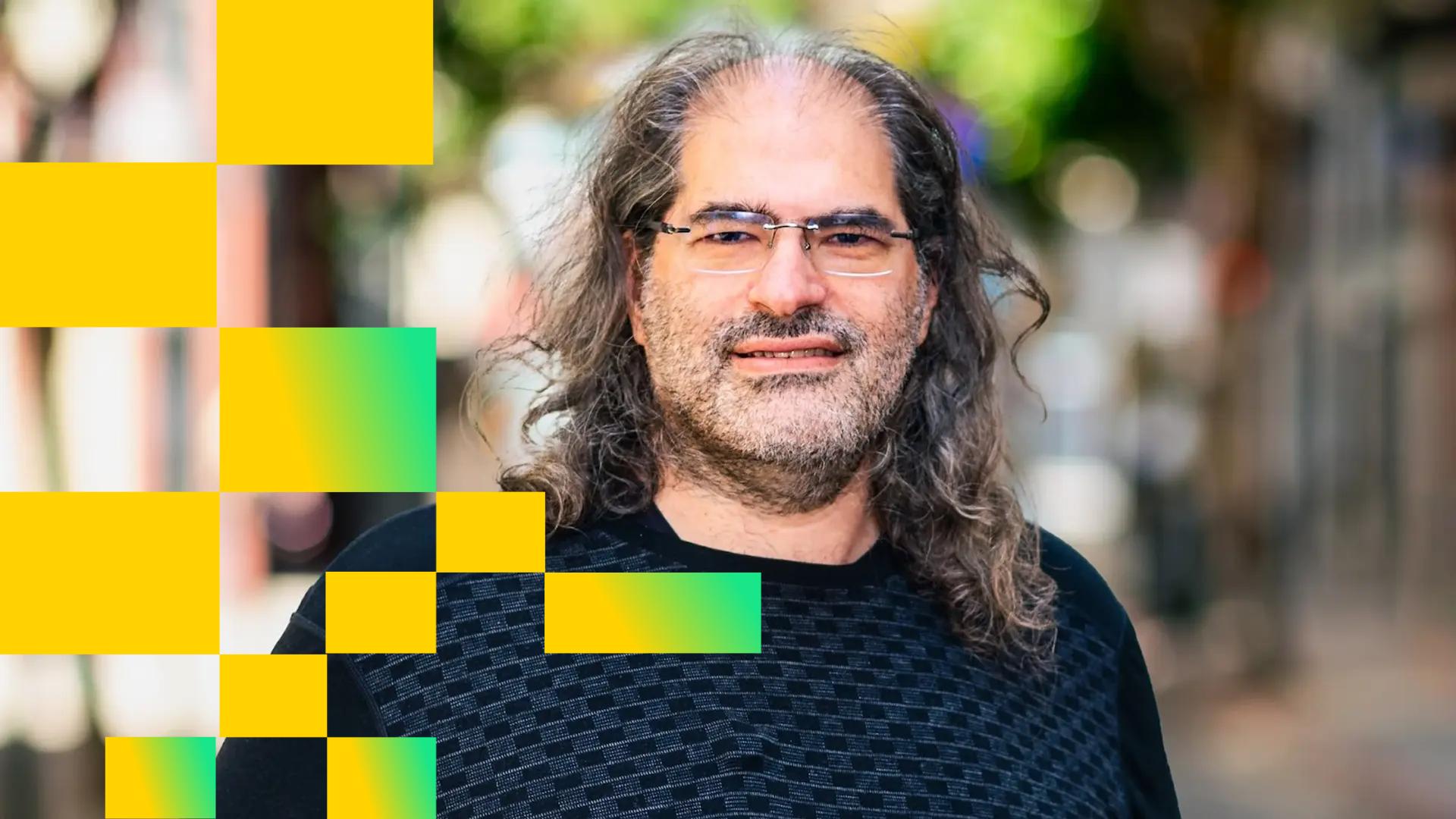

Who is David Schwartz, the XRP mastermind who stepped down as CTO after 13 years

NeutralCryptocurrency

David Schwartz, the long-time CTO of Ripple, is stepping down from his daily role but will continue to contribute as a board member and on XRPL projects. This transition comes at a crucial time as Ripple faces increasing competition from SWIFT, which has partnered with a rival to enhance its offerings. Schwartz's departure marks a significant shift for Ripple, highlighting the evolving landscape of digital finance and the challenges that established players face in adapting to new market dynamics.

— Curated by the World Pulse Now AI Editorial System