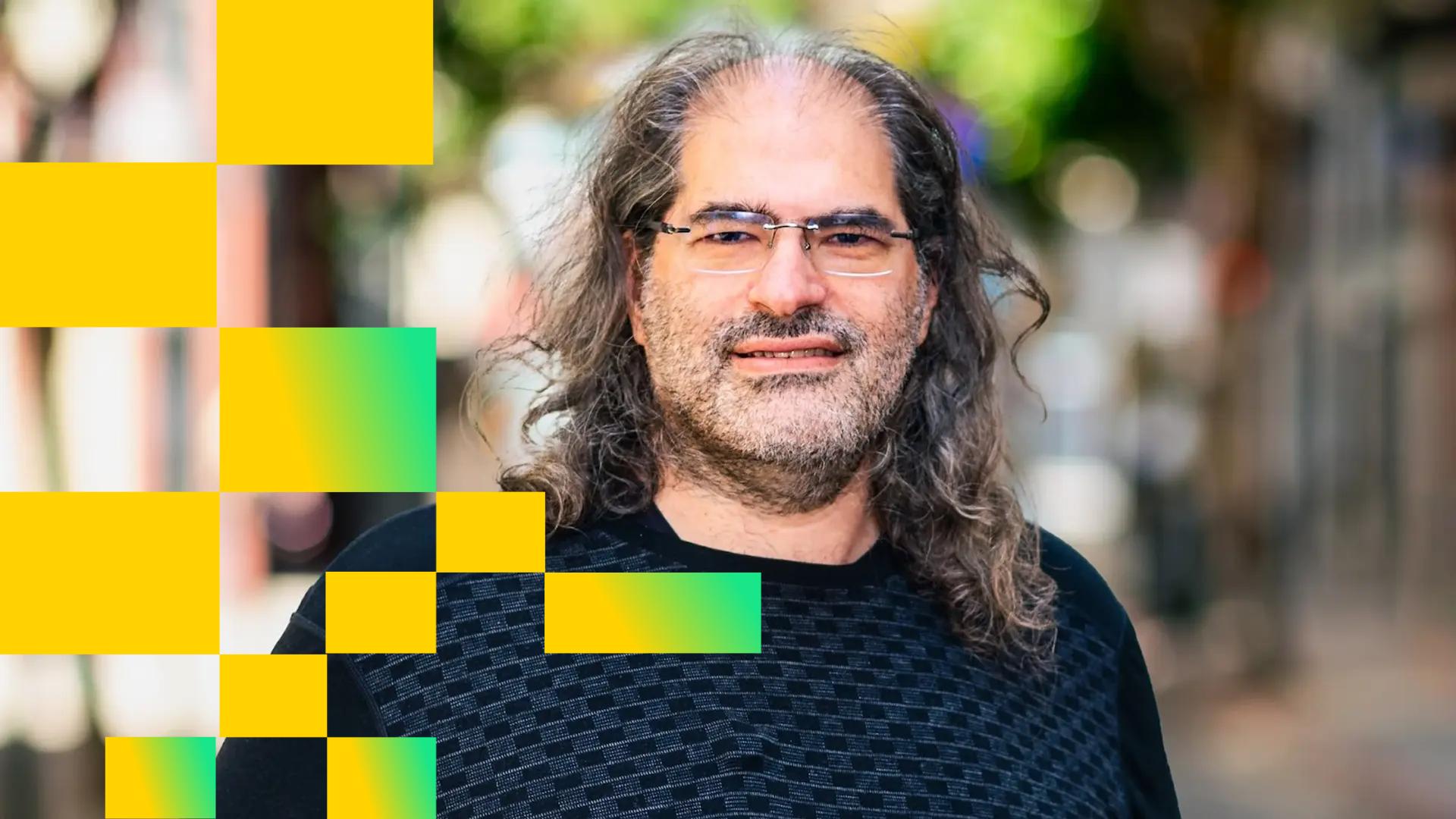

Ripple CTO David Schwartz to Step Back, Joins Board

NeutralCryptocurrency

Ripple's Chief Technology Officer, David Schwartz, has announced that he will be stepping back from his day-to-day responsibilities to join the company's board. This transition is significant as it reflects Ripple's ongoing evolution in the cryptocurrency space, allowing Schwartz to focus on strategic oversight while still contributing to the company's vision. His extensive experience in blockchain technology will be invaluable as Ripple navigates the challenges and opportunities ahead.

— Curated by the World Pulse Now AI Editorial System