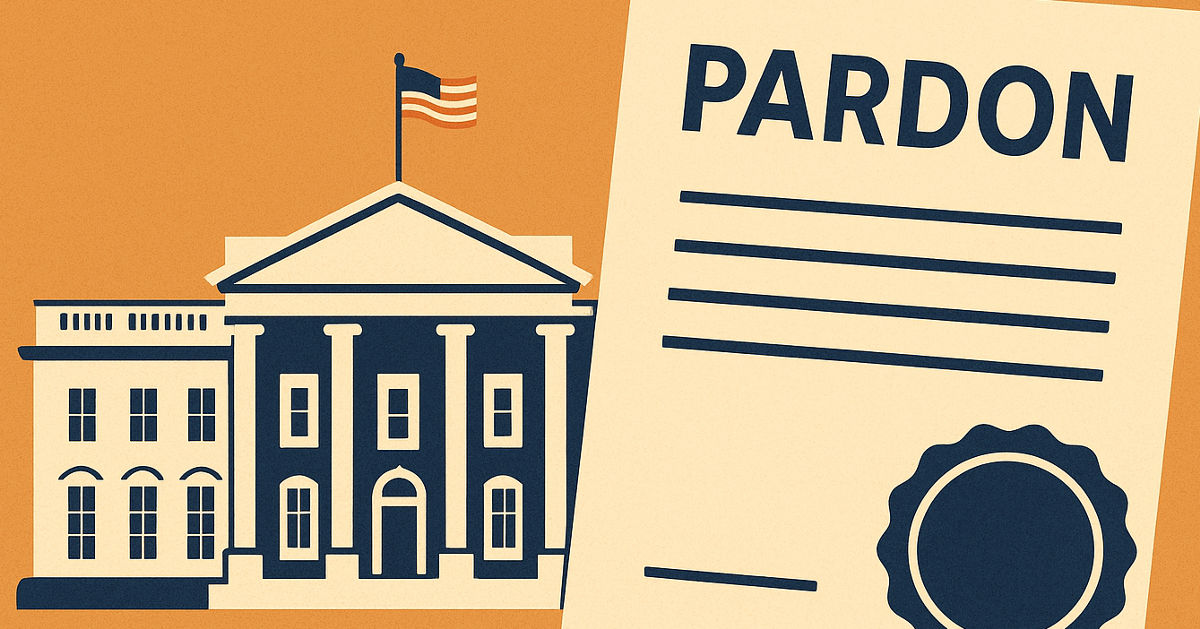

Trump White House Could Soon Pardon Former Binance CEO Changpeng Zhao: FOX

PositiveCryptocurrency

In a surprising turn of events, reports suggest that the Trump administration may soon grant a pardon to Changpeng Zhao, the former CEO of Binance. This potential pardon is significant as it could impact the cryptocurrency landscape and Zhao's future involvement in the industry. The news has sparked discussions among crypto enthusiasts and investors, highlighting the ongoing intersection of politics and digital finance.

— Curated by the World Pulse Now AI Editorial System