MASK Token Speculation Grows After MetaMask Claim Portal Appears

PositiveCryptocurrency

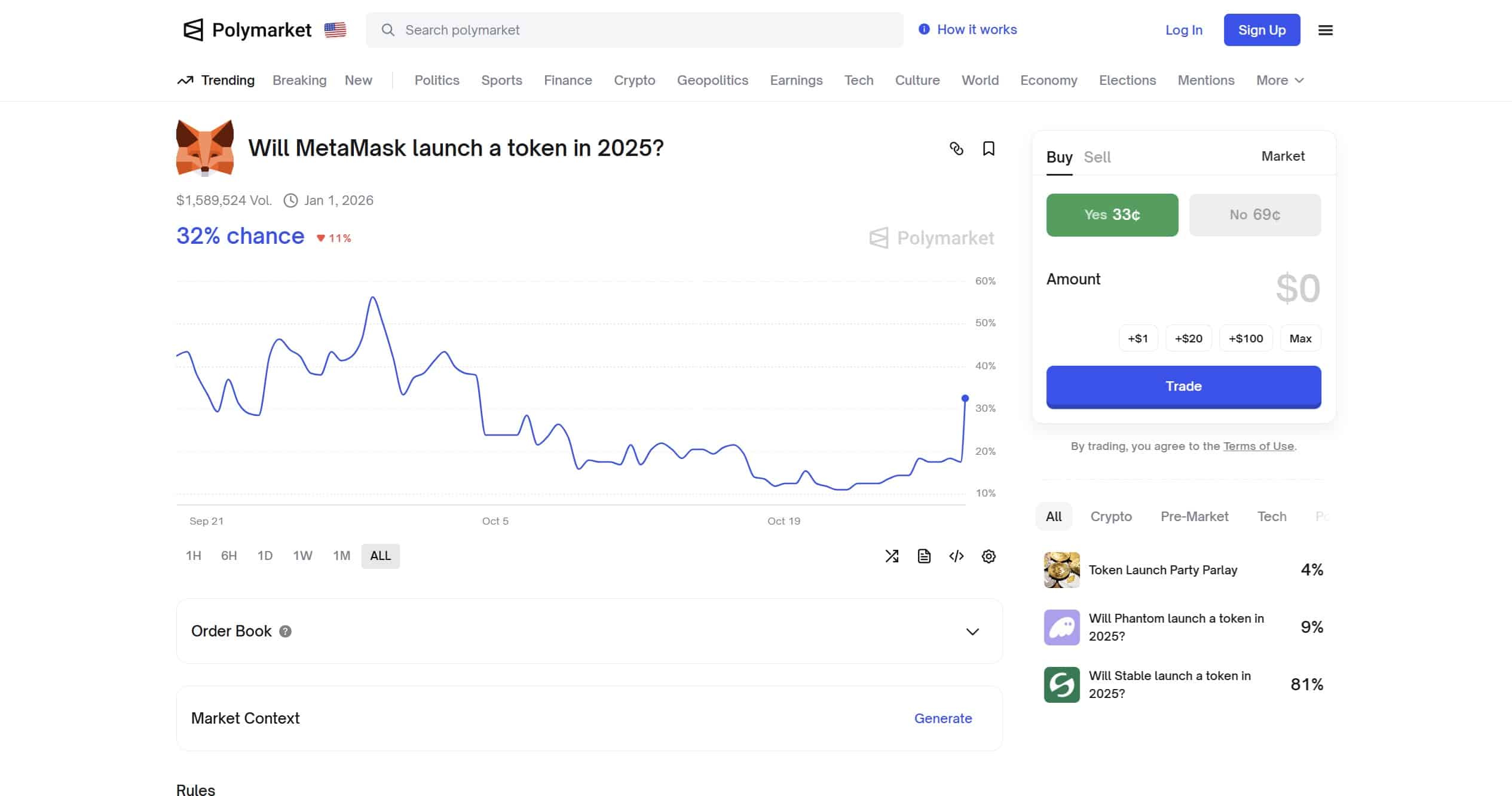

A new claim portal linked to MetaMask has sparked excitement in the crypto community, hinting at the potential launch of the long-anticipated MASK token. This development has led to increased speculation, with Polymarket raising the odds for a 2024 release. The buzz around this portal not only reflects growing interest in MetaMask's future but also highlights the ongoing evolution of cryptocurrency projects, making it a significant moment for investors and enthusiasts alike.

— Curated by the World Pulse Now AI Editorial System