Chainlink Maintains Its Base, But One Push Could Flip Sentiment Fast

PositiveCryptocurrency

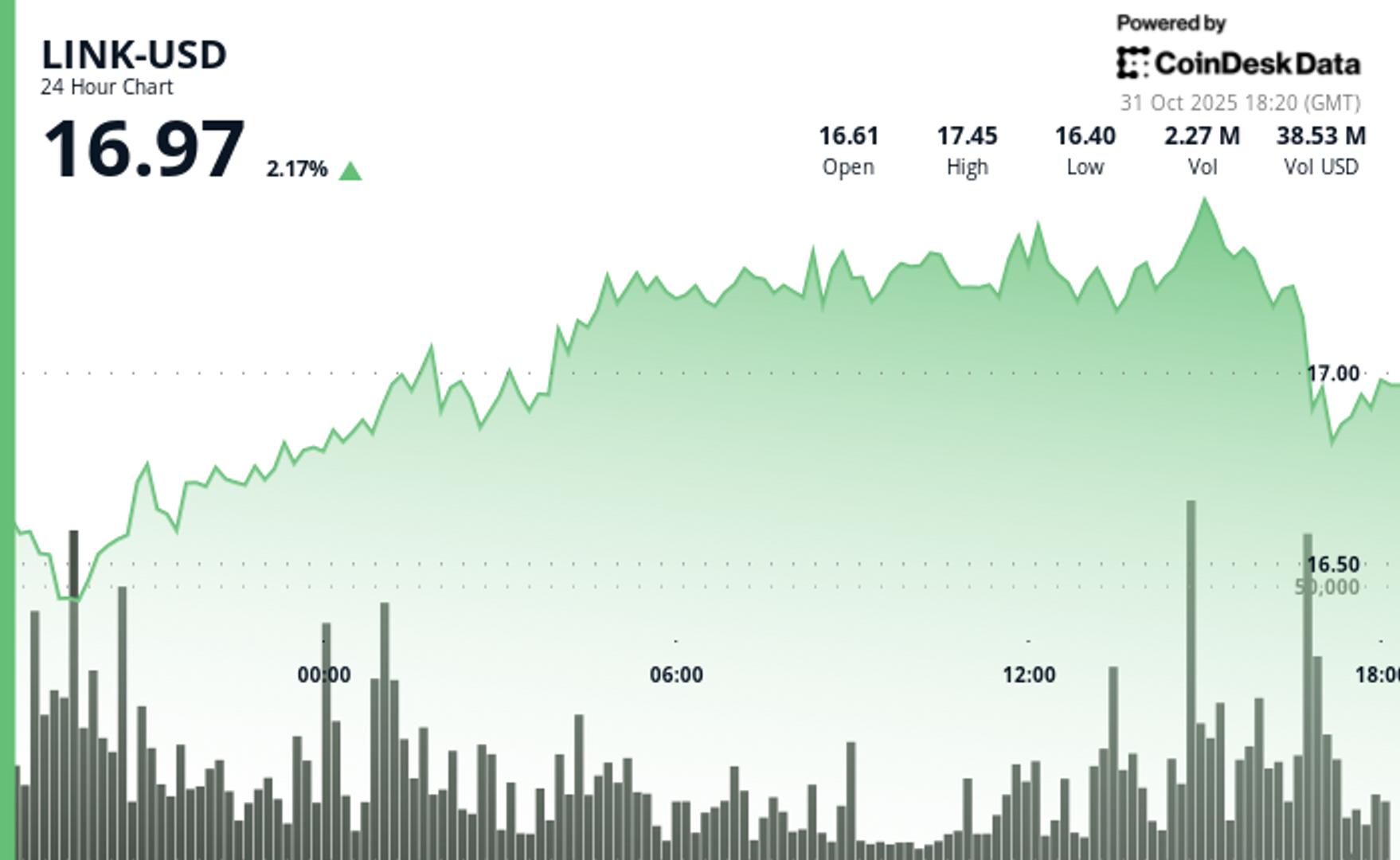

Chainlink is showing resilience by maintaining its position above crucial support levels, which is keeping the market's mood cautiously optimistic. Although recent trading patterns have been mixed, analysts believe that a strong bullish movement could quickly change the sentiment and drive prices higher. This is significant for investors as it indicates potential growth opportunities in the cryptocurrency market.

— Curated by the World Pulse Now AI Editorial System