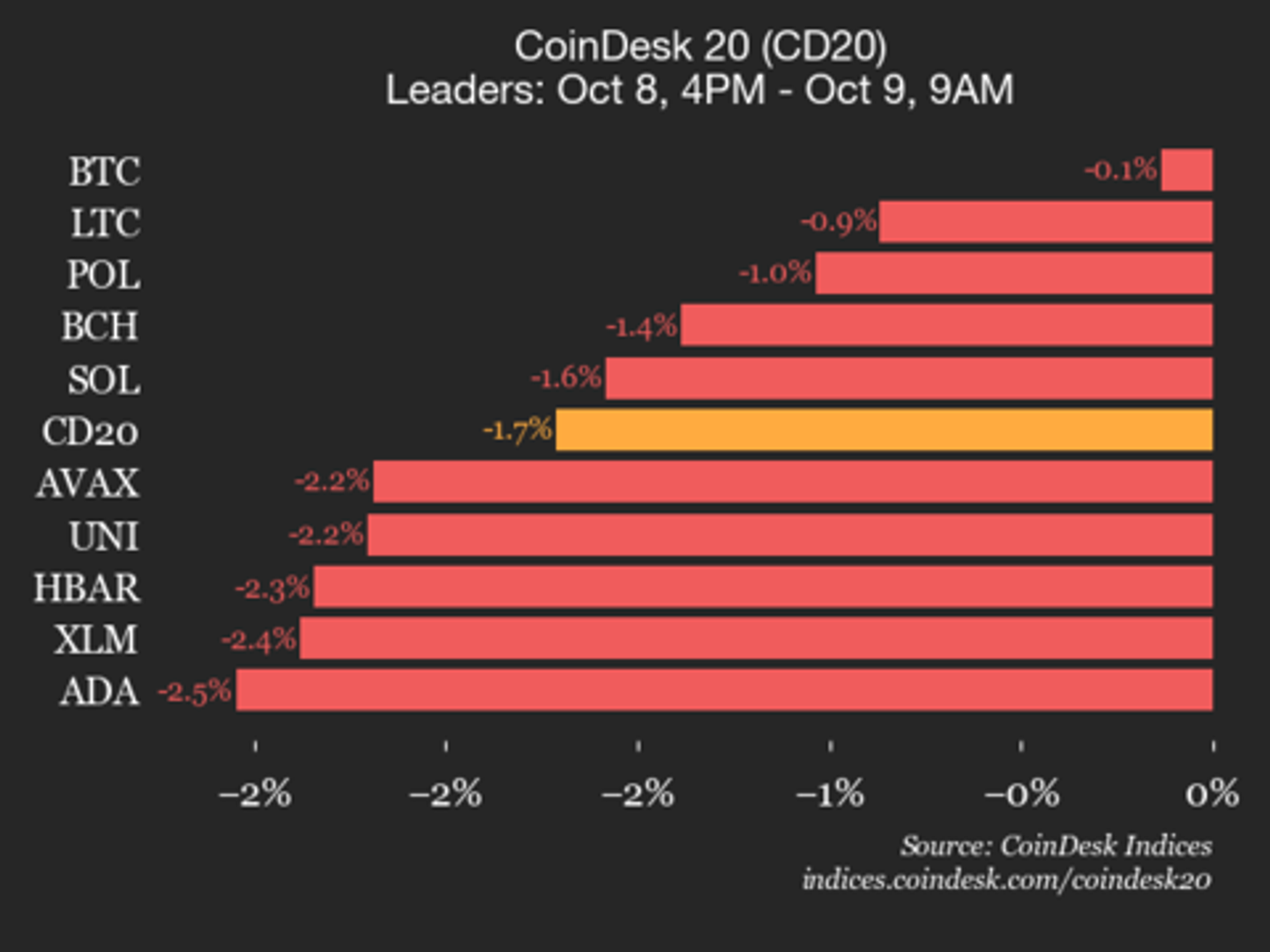

CoinDesk 20 Performance Update: Index Drops 1.7% as All Constituents Trade Lower

NegativeCryptocurrency

The latest CoinDesk 20 performance update reveals a 1.7% drop in the index, with all constituents trading lower. Bitcoin fell by 0.1%, while Litecoin saw a more significant dip of 0.9%. This decline is noteworthy as it reflects the current volatility in the cryptocurrency market, impacting investor sentiment and potentially influencing future trading strategies.

— Curated by the World Pulse Now AI Editorial System