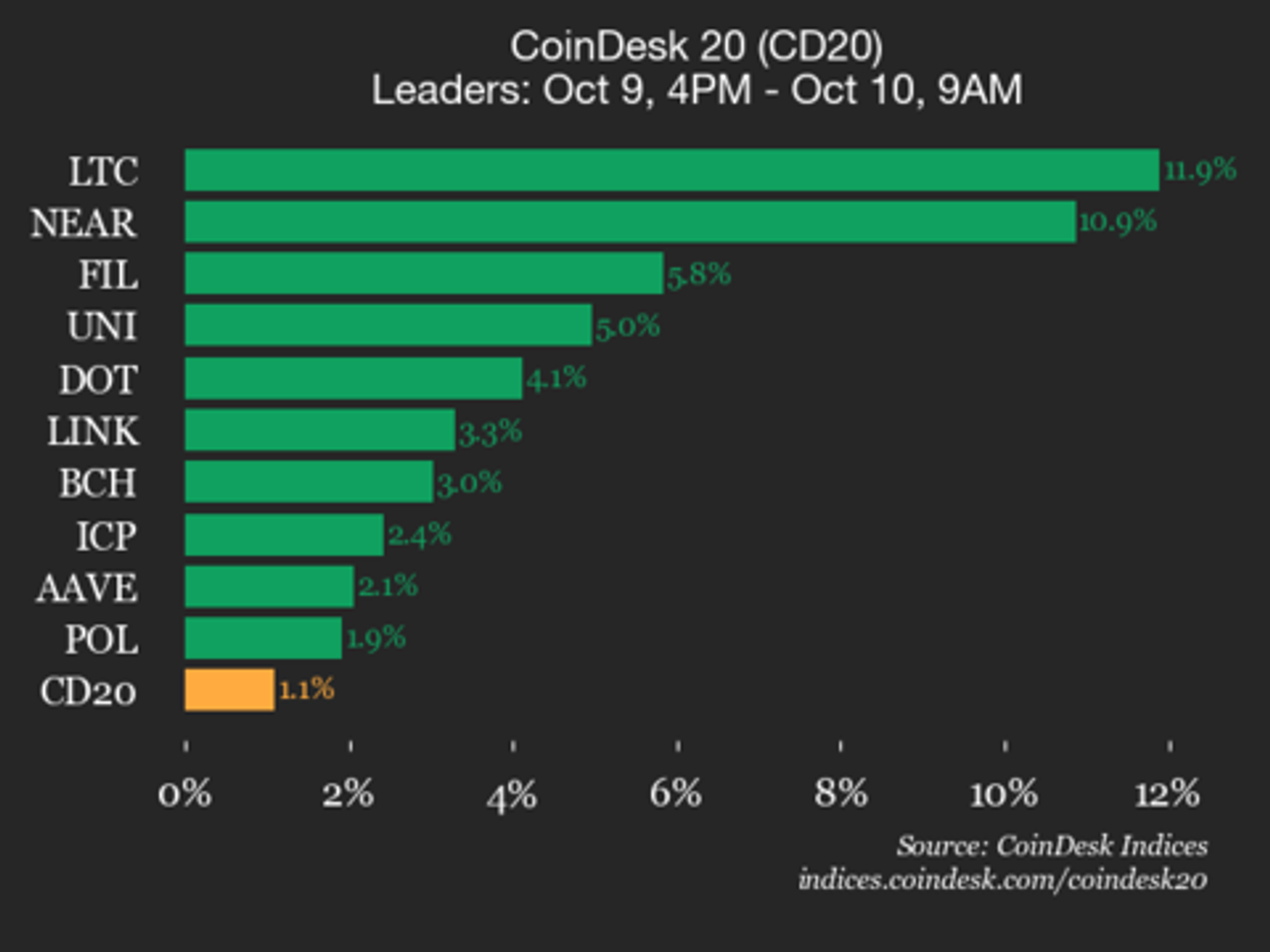

CoinDesk 20 Performance Update: Litecoin (LTC) Surges 11.9% as All Constituents Rise

PositiveCryptocurrency

In a recent performance update from CoinDesk, Litecoin (LTC) has surged by an impressive 11.9%, marking a significant rise among cryptocurrency constituents. NEAR Protocol (NEAR) also shone brightly, gaining 10.9% since Thursday. This upward trend is noteworthy as it reflects growing investor confidence and market momentum in the cryptocurrency space, suggesting a potential recovery or bullish phase for digital assets.

— Curated by the World Pulse Now AI Editorial System